Cashless payments have become popular in this digital era, especially since the Covid-19 pandemic. But in the past few years, some of our studies have found that many of Indonesians still prefer to use cash when shopping. However, since many small and large business players nowadays offer digital payments, have Indonesians shifted their payment preference?

In May 2025, with 4,991 respondents, we found an important behavioral shift among consumers. We also discovered an intriguing fact that the elderly are the ones who prefer cashless payment rather than Gen Z – the digitally savvy generation.

Find out more about our findings in this article.

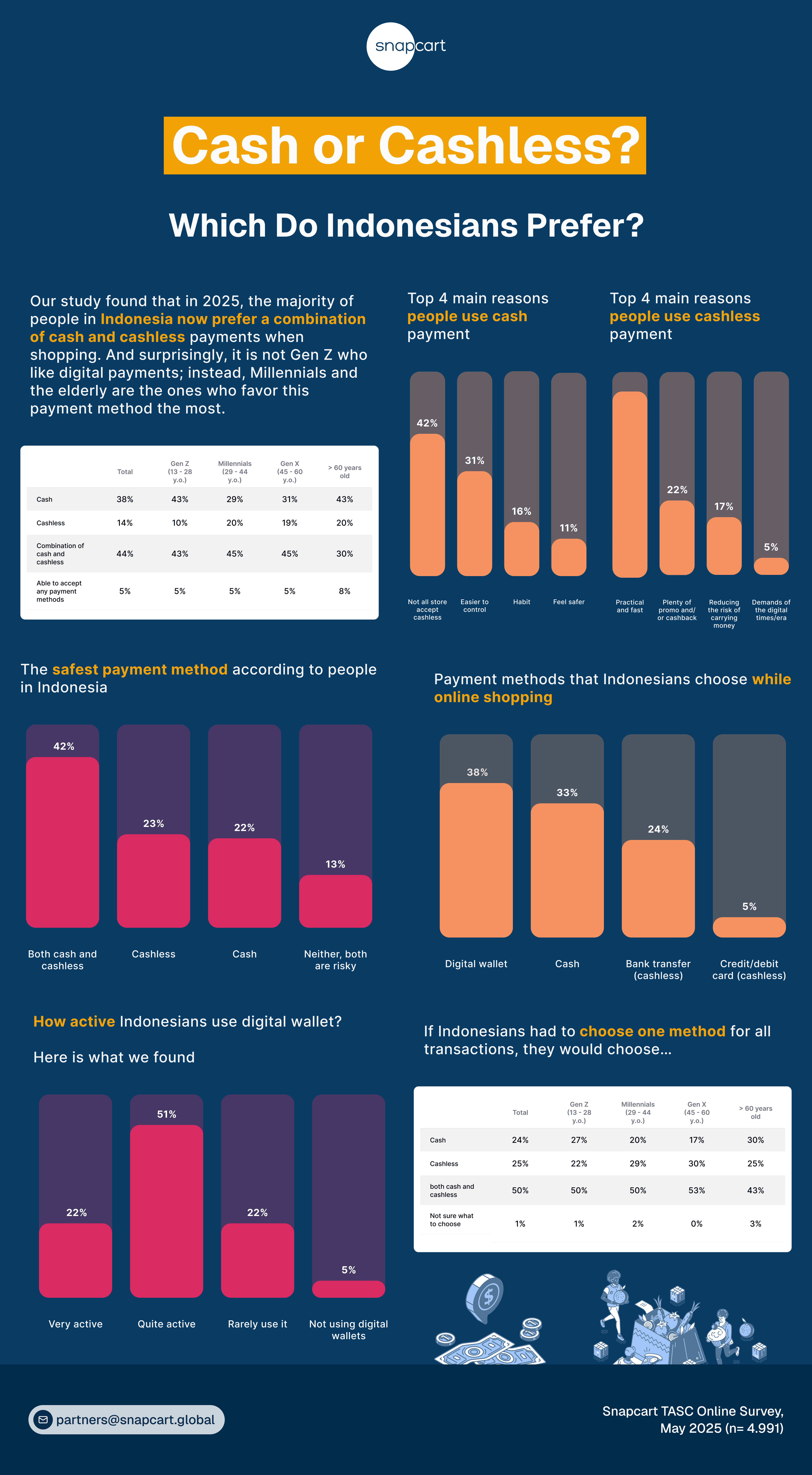

This study shows that 44% of Indonesians prefer using both cash and digital payments depending on the situation — making it the most popular method overall. In contrast, 38% still rely solely on cash, while just 14% have fully transitioned to cashless payments. This finding suggests that while the use of digital payments is growing, cash still plays a vital role in everyday transactions. Rather than abandoning one method for another, Indonesians are integrating both into their lifestyles — a trend with big implications for businesses, fintech platforms, and marketers across the country.

Interestingly, the demographic breakdown challenges common assumptions. Although Gen Z is often seen as the most tech-savvy group, the study found that Millennials (ages 29–44) and Gen X (ages 45–60) are the strongest adopters of hybrid payment methods, with 45% of each group reporting a preference for combining cash and cashless. Meanwhile, 43% of Gen Z respondents still favor cash, with only 10% using cashless exclusively. Among Indonesians aged 60 and above, cash remains dominant (43%), and only 30% embrace the hybrid model. These patterns suggest that adoption is not solely driven by age, but by financial responsibility, access, and consumer confidence.

So, why do people still use cash in the digital age?

The number one reason, cited by 42% of respondents, is that not all stores accept digital payments — especially in rural areas or traditional markets. Another 31% say that cash makes it easier to control spending, while 16% mention it as a matter of habit, and 11% believe it feels safer. These practical concerns highlight ongoing infrastructure and trust issues that limit the full adoption of digital tools. On the flip side, those who favor cashless payments do so for very different reasons: 22% say it’s fast and convenient, 17% enjoy the promos and cashback offers, while others point to reduced risk of theft and alignment with a digital lifestyle. For digital payment providers, these findings are a clear signal — to drive adoption, they must offer not just convenience, but tangible rewards.

When asked which method they feel is safest, 42% of Indonesians answered, “both cash and cashless,” suggesting rising confidence in digital tools without completely discarding traditional ones. Meanwhile, 23% believe cashless is safer, 22% still trust cash more, and 13% feel that both are risky. This distribution shows that security perceptions are improving but still mixed — and educating users remains crucial for broader digital acceptance.

Online shopping behavior further reinforces the rise of digital tools. For e-commerce payments, 38% of Indonesians prefer using digital wallets, 33% still opt for cash (usually through cash-on-delivery), 24% choose bank transfers, and only 5% use credit or debit cards. This aligns with Indonesia’s mobile-first culture, where app-based transactions dominate over traditional banking tools. This research also explored how active Indonesians are in using digital wallets, revealing that 51% are “quite active” and 22% are “very active” users. Only 5% report not using digital wallets at all, suggesting near-universal awareness and availability, even if intensity of use varies.

Finally, when asked to pick only one payment method for all transactions, 50% of Indonesians still chose the combination of cash and cashless. About 25% would go fully cashless, and 24% would stick with cash. This reinforces the overall trend: consumers want options, and they’re not willing to give up either channel completely.

For businesses operating in Indonesia, the takeaway is clear: offering multiple payment options is no longer optional — it’s expected. Consumers demand flexibility, and brands that support both traditional and digital payment experiences will gain a competitive edge. From QRIS-enabled small vendors to e-commerce platforms offering cashback for digital payments, the future belongs to those who adapt to this blended behavior. The hybrid era is here — and it’s shaping the future of commerce in Indonesia.

Looking to understand evolving consumer behavior? Contact us at partners@snapcart.global.