In the first part of this post, we discovered that only 10% of Indonesians rely solely on shampoo without using other hair care products [1].

Hence, with the growing popularity of various hair care items, what drives Indonesians to stay loyal to certain brands?

Check out this article to find out the answer.

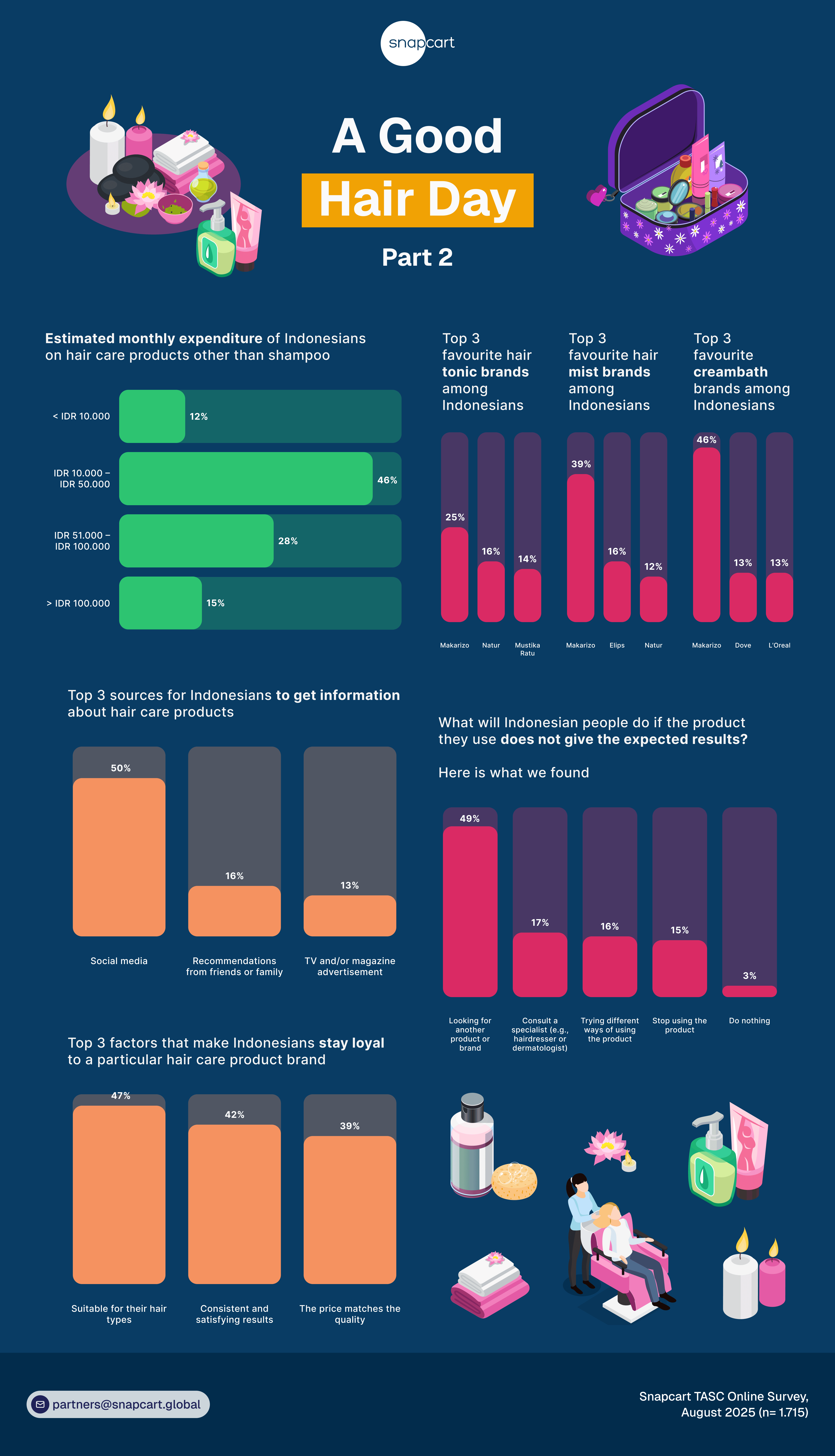

In this study, we found that the spending on hair care varies widely across different groups. In Indonesia, the largest portion of consumers, around 46%, spend between IDR 10,000 and IDR 50,000 per month on hair care products other than shampoo. This suggests that affordable hair care items dominate the market and remain the preferred choice for many.

However, there is also a segment of consumers who are willing to invest more. About 28% spend between IDR 51,000 and IDR 100,000, which reflects an openness to purchase mid-range products that promise better quality or specific benefits. A smaller group, 15%, allocate more than IDR 100,000 monthly, highlighting the presence of a premium market for those seeking advanced treatments or branded international products. On the other end, 12% spend less than IDR 10,000, showing that a portion of consumers still focus on the most basic and budget-friendly options.

Favorite Hair Care Brands

Brand preference plays a strong role in Indonesian hair care decisions. For hair tonic, Makarizo is the leader with 25% of respondents choosing it, while Nator is favored by 16% and Mustika Ratu by 14%. These results suggest that both local and heritage brands maintain relevance in this category.

When it comes to hair mist, Makarizo dominates again with 39%, reflecting strong brand recognition and consumer trust. Ellips secures 16%, while Natur follows closely with 12%, showing that the market is not solely concentrated in one brand, but still leaves room for competition.

For creambath products, Makarizo continues its strong position, leading with 46%. Dove and L’Oreal, two international names, each capture 13% of the market, indicating that while local players are popular, international brands still have significant influence among Indonesians who want globally recognized options.

Brand Awareness

Information sources heavily influence how Indonesians choose their hair care products. Social media is the top channel, with 50% of respondents stating that platforms like Instagram, TikTok, and YouTube are where they discover new products, reviews, and tutorials. This reflects the growing importance of digital content, influencers, and beauty creators in shaping consumer decisions.

Despite the digital trend, word of mouth remains powerful. About 16% of respondents rely on recommendations from friends or family, which highlights the trust placed on personal experiences when it comes to beauty and self-care products. Meanwhile, 13% still gather information from more traditional media such as TV and magazine advertisements, showing that offline channels continue to play a role, especially for certain demographics.

Brand Loyalty

In this survey, around 47% of consumers say they remain loyal to a product because it is suitable for their hair type, proving that personalization and compatibility matter most. Another 42% emphasize the importance of consistent and satisfying results, showing that performance is critical for long-term trust.

Price also plays a significant role, with 39% stating that they stay loyal to a brand because the price matches the quality. This suggests that while effectiveness is the top priority, affordability cannot be ignored, and brands must balance both aspects to maintain customer loyalty.

Nevertheless, hair care expectations are high, and Indonesians do not hesitate to take action when results fall short. This survey shows that 49% of people would simply switch to another brand if the product they are using does not perform as expected. This reveals how competitive the market is, with consumers showing little patience for ineffective items.

Another group, around 17%, chooses to consult specialists like hairdressers or dermatologists, reflecting a willingness to seek professional advice for better solutions. About 16% prefer to experiment by trying different ways of using the same product before abandoning it, while 15% stop using the product altogether if the results are disappointing. Only 3% of consumers say they would do nothing, making it clear that the vast majority are proactive in their approach to hair care.

Need to learn more about consumer habits and behavior? Contact us at partners@snapcart.global.

Reference: