In 2025, the Indonesian government are giving free lunch to students in Indonesia. Not just for fulfilling stomach, the foods & beverages that are given in this program are also nutritious, that it will include UHT milk to support the students’ health and increasing their ability to learn.

However, how many people and/or family in Indonesia are used to drink UHT milk in their daily life?

Will students in Indonesians love to consume this free drink in the future?

In November 2024, Snapcart conducted a study to find out people in Indonesia’s habit in consuming UHT milk and some factors that could influence them in consuming this type of highly nutritious drink. And with 504 respondents from various ages, we discovered further about Indonesians’ preferences in consuming this type of milk from generation to generation, as represented in the infographic below.

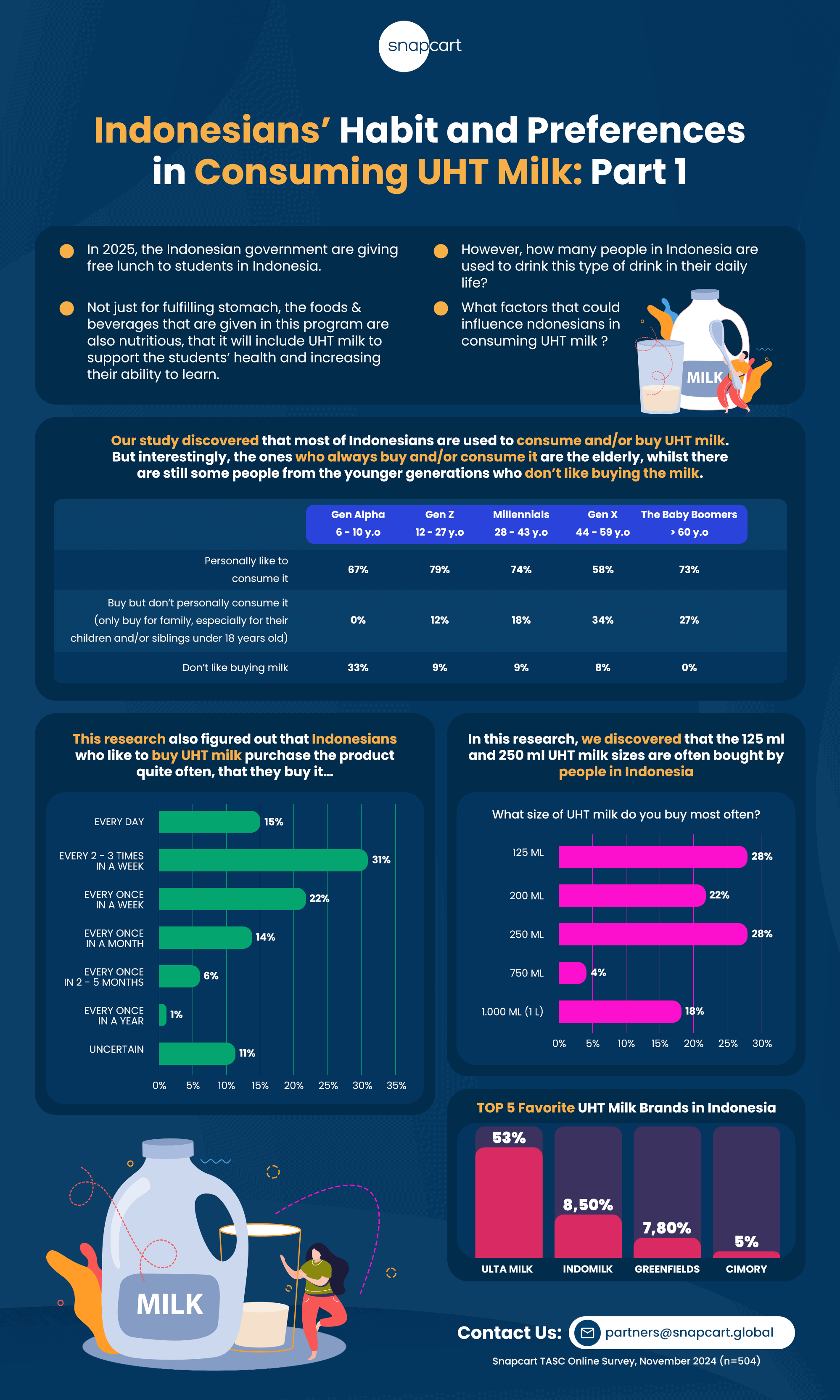

This research discovered that interestingly, while UHT milk is widely consumed across different age groups, the study revealed notable variations:

- Gen Alpha (6–10 years): 67% consume UHT milk because they personally enjoy it.

- Gen Z (12–27 years): The highest percentage (79%) of personal consumers was found in this group.

- Millennials (28–43 years): 74% consume UHT milk personally, with an additional 18% buying it for children or younger siblings.

- Gen X (44–59 years) and Baby Boomers (60+ years): Older generations remain dedicated consumers, with 58% (Gen X) and 73% (Baby Boomers) consuming it for themselves.

The younger generation, especially Gen Alpha, shows some resistance, with 33% not consuming UHT milk at all.

Frequency of UHT Milk Consumption

When it comes to buying habits, Indonesian consumers show impressive loyalty:

- 15% of respondents drink UHT milk daily.

- 31% purchase it two to three times a week.

- 22% consume it once a week.

Despite this, there is a smaller group (1%) that only purchases UHT milk once a year, indicating occasional use among some households.

Popular UHT Milk Sizes

Among the sizes available, 125 ml and 250 ml emerge as the most popular choices, with 28% of respondents favoring each. Larger sizes like 750 ml and 1 liter have fewer buyers, likely due to storage and portability preferences.

Favorite UHT Milk Brands in Indonesia

The study also revealed the top five UHT milk brands loved by Indonesians:

- Ulta Milk – Dominates with a strong 53% preference rate.

- Indomilk – A distant second at 8.5%.

- Greenfields – Preferred by 7.8% of respondents.

- Cimory – Garnered 5% of the votes.

Factors Influencing UHT Milk Consumption

The popularity of UHT milk can be attributed to its long shelf life, convenience, and nutritional value. However, preferences across age groups indicate that marketing efforts targeting younger generations could help boost adoption among Gen Alpha and Gen Z who are less inclined to consume UHT milk.

With the growing emphasis on nutrition through government initiatives and evolving consumer preferences, the UHT milk market in Indonesia continues to be dynamic. Understanding these trends is crucial for brands looking to capture or expand their market share.

For more information, contact us at partners@snapcart.global.