Our recent study showed that the Baby Boomers generation buy and drink more UHT milk rather than the younger ones, and Ultra Milk is on the top rank as the most favourite UHT milk brand for many people from all generations in 2024 [1].

In this article, our research discovered further about their references in choosing UHT milk products to consume, as represented in the infographic below.

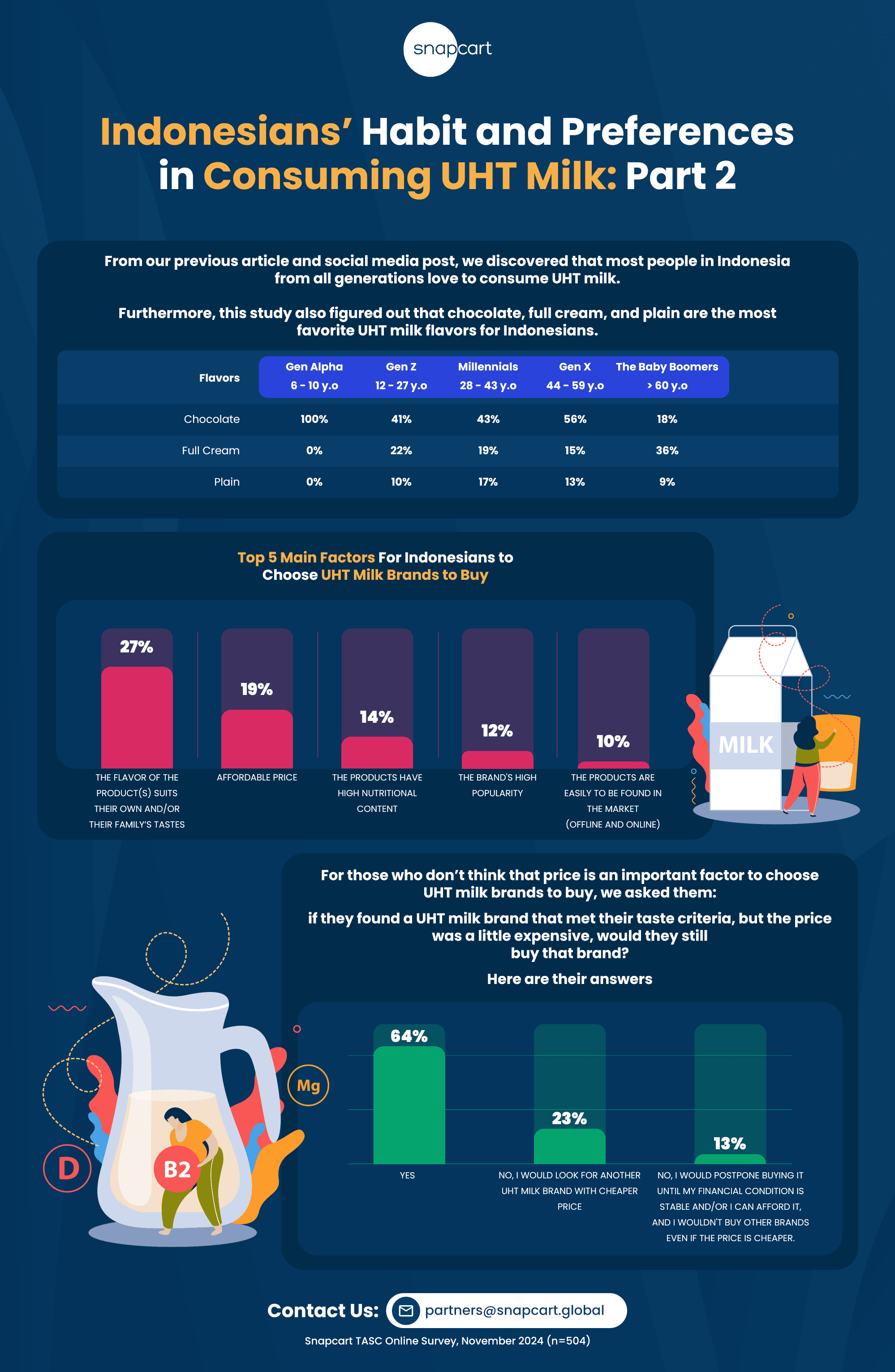

Preferred UHT Milk Flavors Across Generations

The study reveals that UHT milk is a favorite beverage across all age groups in Indonesia, with specific flavor preferences varying by generation:

- Gen Alpha (6–10 years old): Chocolate dominates at 100% preference, showing how younger children favor sweet and familiar flavors.

- Gen Z (12–27 years old): While chocolate remains the most popular choice (41%), full cream (22%) and plain (10%) also gain attention.

- Millennials (28–43 years old): Preferences diversify slightly, with chocolate (43%), full cream (19%), and plain (17%) as the top three flavors.

- Gen X (44–59 years old): Chocolate still leads (56%), but full cream (15%) and plain (13%) follow closely.

- Baby Boomers (60+ years old): Full cream becomes the most popular (36%), while chocolate (18%) and plain (9%) take the backseat.

This generational breakdown highlights how taste preferences shift over time, with older consumers leaning toward simpler and less sweet options.

Top Factors Influencing UHT Milk Brand Choices

When selecting a UHT milk brand, Indonesians prioritize several factors:

- Flavor Suitability (27%): The top consideration is how well the flavor matches personal or family preferences.

- Affordable Price (19%): Budget-friendliness is a significant driver of purchase decisions.

- Nutritional Content (14%): Consumers value milk brands that offer health benefits.

- Brand Popularity (12%): Recognized and trusted brands enjoy an edge.

- Availability (10%): The ease of finding products in both offline and online markets influences choice.

These insights emphasize the importance of balancing taste, price, and nutritional value when catering to the Indonesian market.

Willingness to Pay More for Quality UHT Milk

Interestingly, not all Indonesians are price-sensitive when choosing UHT milk. When asked whether they would buy a slightly expensive UHT milk brand that met their taste criteria, the responses were:

- 64% said yes: These consumers prioritize flavor and quality over price, reflecting loyalty to their favorite brands.

- 23% would switch brands: They would opt for a cheaper alternative if the price exceeded their budget.

- 13% would postpone the purchase: These respondents prefer to wait until their financial situation stabilizes or save for their preferred brand rather than compromising on quality.

All in all, this study underscores that UHT milk is a staple beverage for Indonesians across generations. While flavour remains the most critical factor, price and nutritional content also play essential roles in shaping purchasing decisions. Moreover, the willingness of 64% of respondents to pay more for quality highlights an opportunity for brands to focus on premium products that meet consumers’ taste and health expectations.

For brands targeting the Indonesian market, the key takeaway is clear: offering a variety of flavors, maintaining affordability, and emphasizing nutritional benefits can help capture a larger share of this thriving market.

For more information, contact us at partners@snapcart.global.

Source:

[1] https://snapcart.global/indonesians-habit-and-preferences-in-consuming-uht-milk-part-1/