Investing is becoming an increasingly important topic worldwide, and Indonesia is no exception.

Thus, in order to find out more about Indonesians’ perspectives on investment, in April 2025, Snapcart conducted a study that revealed people in Indonesia’s priorities, sources of knowledge, and preferred investment types.

Check out some valuable insights gathered from this research in this article.

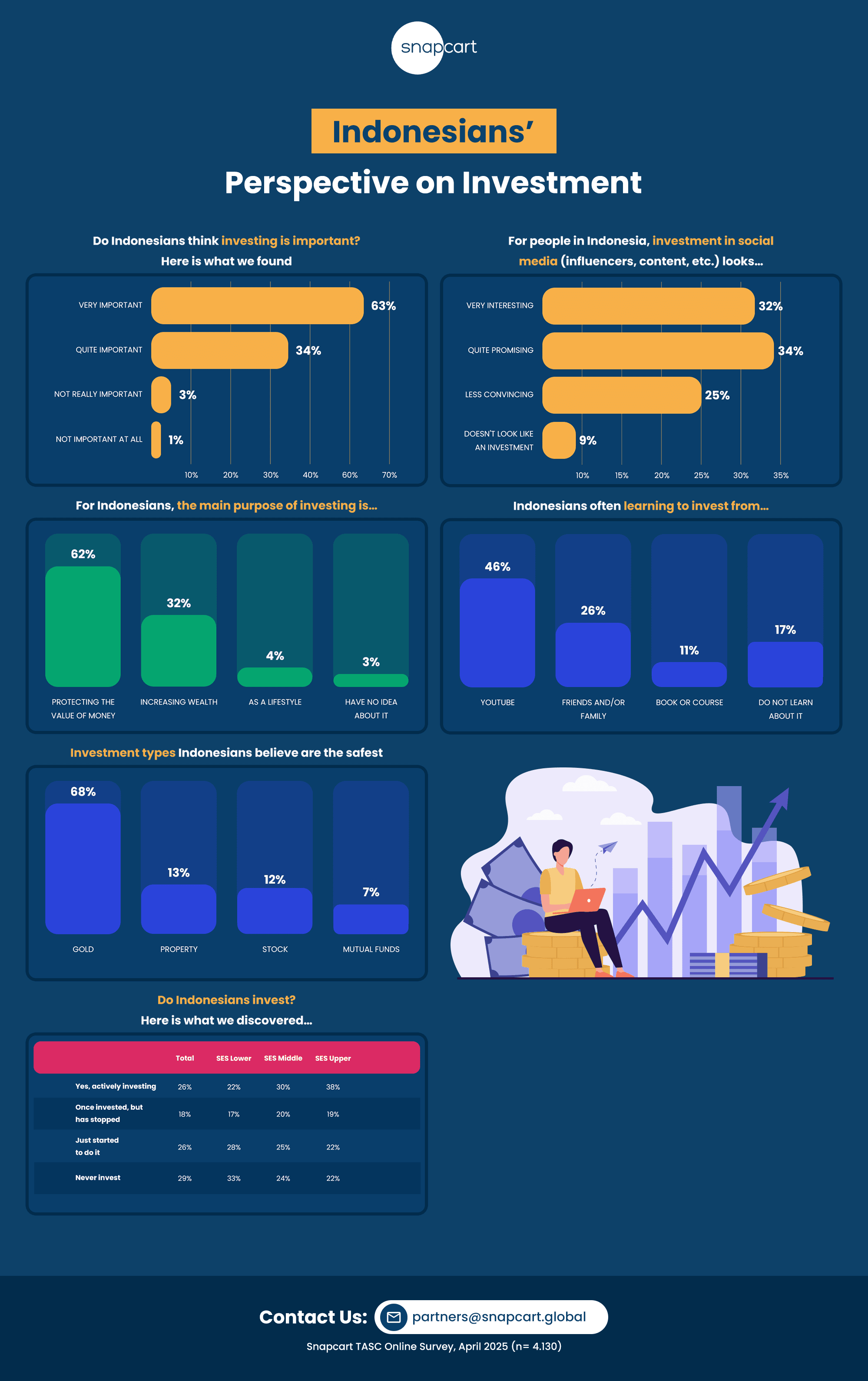

Our data found that the majority of Indonesians agree that investing is important. According to this survey, 63% of respondents consider investing very important, and 34% deem it quite important. Only a small percentage, 3%, think investing is not really important, and just 1% don’t think it’s important at all. This highlights a growing awareness of the importance of investment in financial planning.

Anggia, Research Manager of Snapcart, in Jakarta (30/4) stated, “This study discovered varying levels of investment activity across different socioeconomic groups. Overall, 26% of respondents are actively investing, while 18% have invested in the past but have stopped. A notable 20% of individuals have just started investing, while 29% of respondents have never invested.”

The survey also breaks down investment activity by socioeconomic status (SES):

- SES Lower: Only 22% are actively investing.

- SES Middle: 30% of respondents are actively investing.

- SES Upper: A higher 38% of respondents are actively investing.

This data shows that socioeconomic status plays a significant role in determining the level of engagement with investment practices.

When it comes to the primary motivation for investing, 62% of Indonesians see investment as a means of protecting the value of money. Following closely, 32% are focused on increasing wealth, while 4% consider it a lifestyle choice, and only 3% admit they have no idea about the purpose of investing.

Additionally, this research also revealed that most Indonesians do not invest blindly; instead, they educate themselves and approach financial planning thoughtfully. Our findings discovered that 46% of Indonesians turn to YouTube for advice and information. This highlights the growing role of online platforms in providing educational content about financial matters. Additionally, 26% rely on friends and family for guidance, while 11% opt for books or courses to deepen their investment knowledge. Interestingly, 17% of respondents don’t actively seek out investment-related learning.

Many Indonesians are careful in investing. When it comes to the safety of investments, Indonesians largely prefer traditional investment methods. The majority of them (68%) consider gold to be the safest investment type, followed by property (13%) and stocks (12%). Only 7% believe mutual funds are the safest. This preference for gold and property highlights the cautious approach many Indonesians take toward investing, focusing on tangible and familiar assets.

Investment in Social Media: A Promising Trend or a Fad?

Investment in social media, including influencers and content creators, is still an emerging trend in Indonesia. This research reveals that 32% of Indonesians find it very interesting, and 34% believe it is quite promising. However, a quarter of the respondents (25%) feel that social media investment is less convincing, while 9% don’t see it as an investment at all. This indicates that while there is interest, scepticism still exists when it comes to social media-driven investment opportunities.

For more information, contact us at partners@snapcart.global or anggia@snapcart.global.