Shopping centers in Indonesia, once the heart of modern urban life, are now witnessing a steady decline in foot traffic. Plenty of news reports revealed that visitors are still rarely seen, and lots of stores are even closed permanently in those buildings that used to be people’s destination to shop and/or refresh their minds.

Thus, in order to check the real reasons of this phenomenon, in May 2025, Snapcart conducted a study with 1.514 respondents. Is it true that the rising of online shopping trend is the only primary cause of this issue? What could bring people back to shopping centers?

Check out the answers in this article.

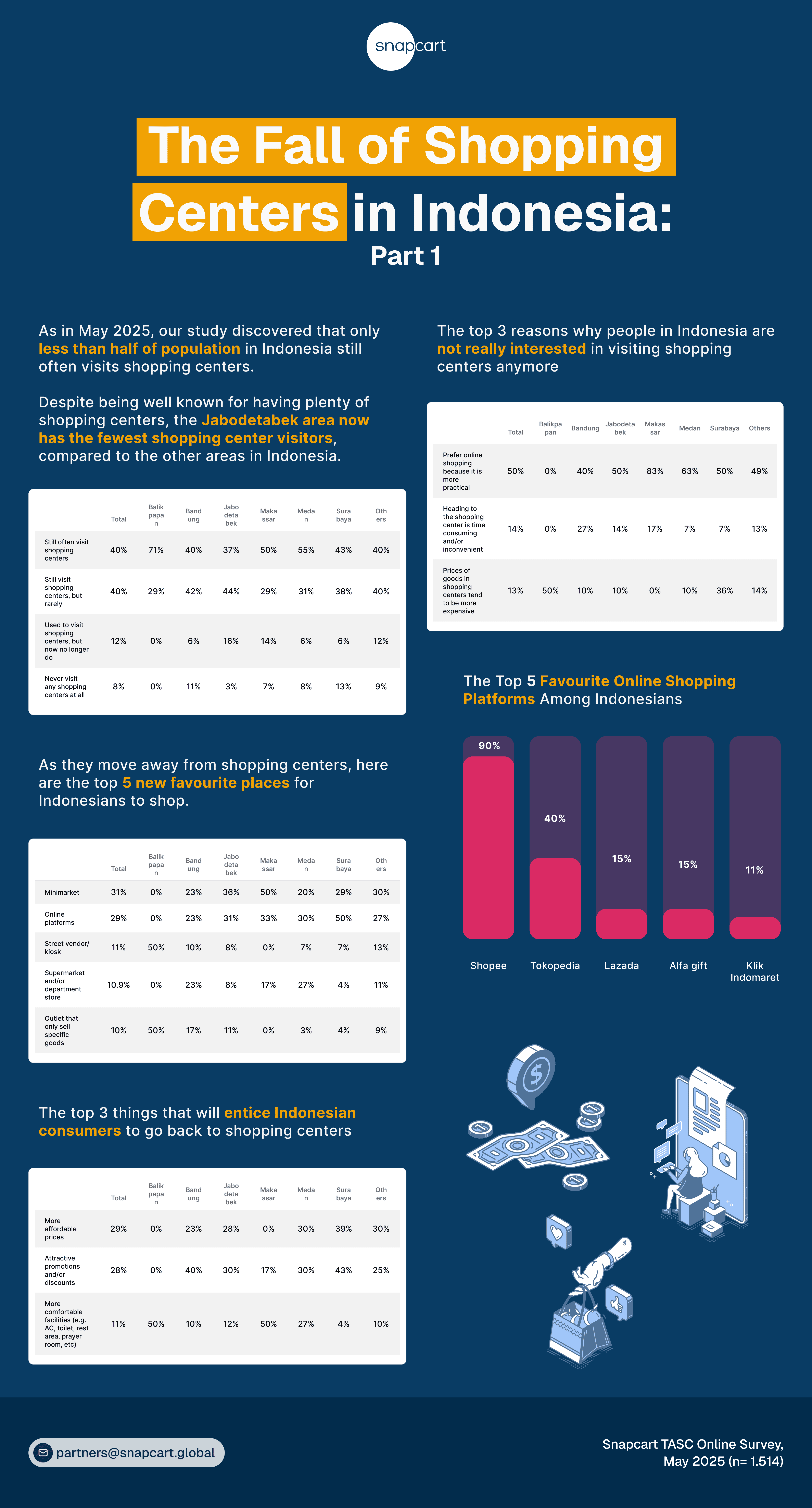

Helena Suri, Sales Manager of Snapcart in Jakarta (28/5) said, “Among all regions in Indonesia, we found that ironically, the Jabodetabek area has the lowest number of shopping center visitors, despite being home to some of the country’s largest and most iconic retail destinations.”

Nationally, only 40% of the population still frequents shopping malls, but in Jabodetabek, the figure drops even further to just 37%. This regional trend marks a stark contrast to areas like Balikpapan and Medan, where mall visitation is relatively higher.

Furthermore, we also found that indeed, the main reason Indonesians are avoiding shopping centers is the growing preference for online shopping, which 50% of respondents said is more practical. Additionally, 14% of participants expressed that going to shopping centers is time-consuming and inconvenient, especially in traffic-congested cities, while another 13% pointed out that prices at shopping malls tend to be more expensive than those found online or at local stores. These factors combined have driven many Indonesians to change their shopping habits significantly.

Nevertheless, even though half of the population in Indonesia has moved to online shopping, this survey revealed that in reality, minimarkets have become the most popular choice for Indonesians to shop in this era, as the majority of respondents (31%) said they often shop there, meanwhile online platforms are a close second, used by 29% of participants who favor them for the variety, ease, and competitive pricing they offer.

Aside from minimarkets and shopping platforms, as other alternatives to the shopping centers, 11% of Indonesians now prefer buying from street vendors or kiosks, which are often seen as more affordable and community-friendly. Supermarkets and department stores still maintain a modest share at around 10.9%, while specialty outlets that focus on specific goods account for 10% of shopping preferences.

Moreover, as online shopping trend gains popularity, this research also discovered the most popular online shopping platforms in Indonesia. We found that in the digital retail space, Shopee emerges as the dominant force, used by a staggering 90% of online shoppers. Followed by Tokopedia that holds the second spot with 40% usage, while Lazada and Alfa Gift follow behind with 15% each. Klik Indomaret also makes the list, preferred by 11% of users, especially those seeking convenient grocery delivery or localized services.

What Will Bring Consumers Back to Shopping Malls?

Despite the decline, there is still potential to revitalize shopping centers in Indonesia. This survey shows that 29% of respondents would consider returning to malls if more affordable prices were offered, which means that competitive pricing could help malls better compete with online platforms. Attractive promotions and discounts are also a strong motivator, appealing to 28% of shoppers who are increasingly price-sensitive. Moreover, 11% of participants indicated that enhanced comfort—such as better air conditioning, clean toilets, prayer rooms, and designated rest areas—would make them more likely to visit shopping centers again. Hence, these improvements in the shopping experience could be key to winning back consumers.

To be continued in part 2.

For more information about this article, contact helena@snapcart.global or haifa.chairunisa@snapcart.global.

Looking to understand the reasons behind consumers’ changing behavior and explore possible solutions? Contact us at partners@snapcart.global.