In the first part of this article, our study found that there are only 40% of Indonesians who still often visit shopping centers [1].

Thus, do most Indonesians find that shopping centers are still relevant in this modern era, where online shopping is getting more popular?

Check the completed result of this study in this article.

Our data reveals that shopping behavior in Indonesia is indeed evolving.

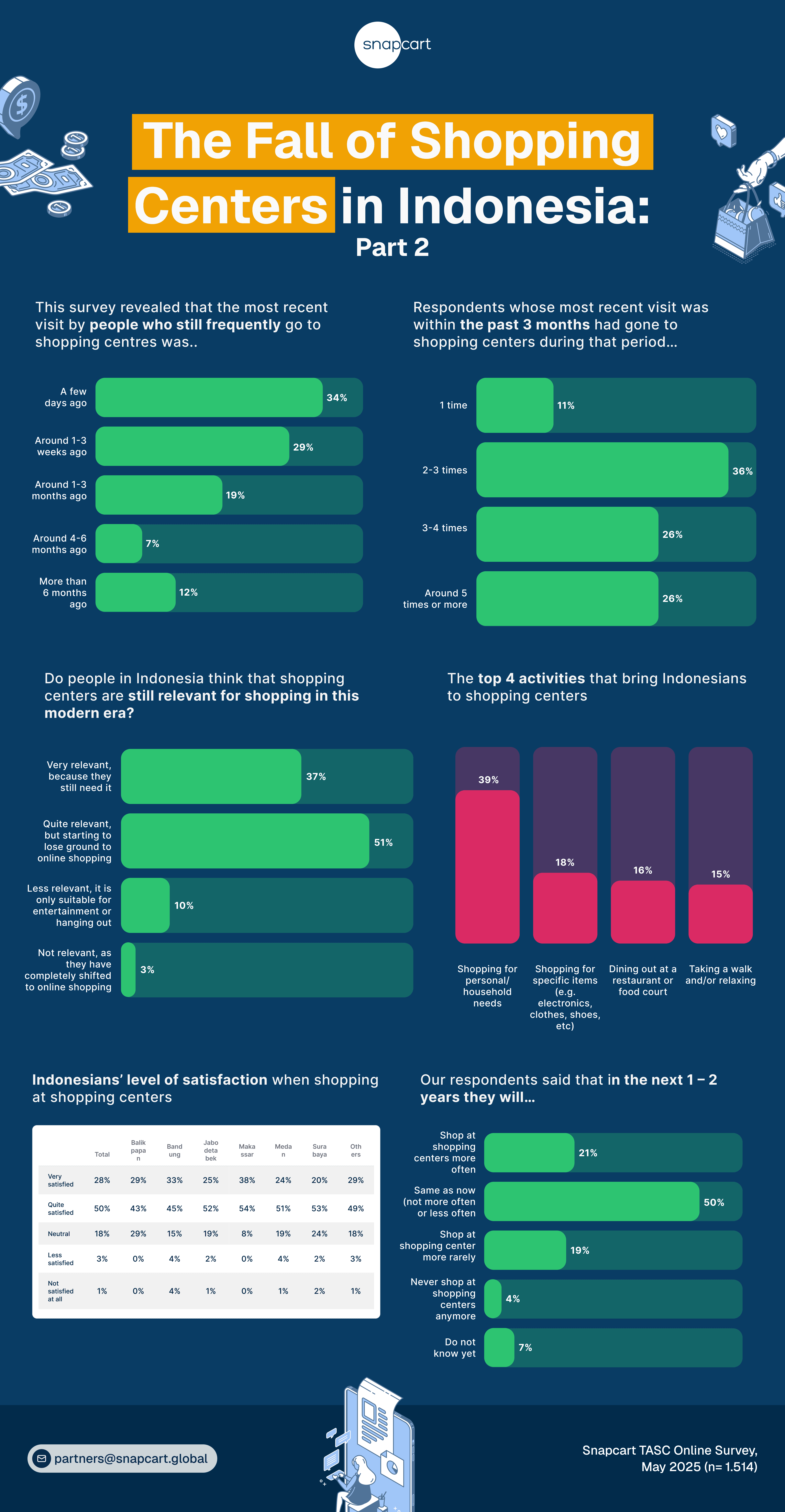

Among people who still frequently visit shopping centers, 34% said their most recent visit was just a few days ago, while 29% had visited in the last one to three weeks. Meanwhile, 19% said they had last gone to a shopping center one to three months ago. A noticeable 12% hadn’t visited in more than six months. These findings portray a steady decline in footfall for some shoppers, reflecting broader lifestyle and purchasing shifts in a digitally connected society.

Moreover, for respondents whose most recent visit was within the past three months, 36% had gone to shopping centers two to three times, while 26% had visited three to four times, and another 26% reported going around five times or more. Only 11% had visited just once in that period. This distribution shows that although shopping centers are still a destination for many, the frequency of visits is gradually tapering off for a significant portion of the population.

On the other side, when asked about their level of satisfaction, 28% of Indonesians reported being very satisfied with their shopping center experience, while 50% were quite satisfied. A neutral stance was taken by 18%, and only 1% said they were not satisfied at all. Satisfaction levels varied across cities, with Makassar showing the highest “very satisfied” response at 38%, while Surabaya reported the lowest at 20%. These statistics reflect generally positive sentiment, although there are clear regional differences in shopping experiences.

Are Shopping Centers Still Relevant in the Digital Age?

Despite the rise of e-commerce, 37% of survey respondents believe that shopping centers remain very relevant, especially for essential needs. Meanwhile, 51% feel that malls are still quite relevant but are beginning to lose ground to online platforms. Only a small minority (10%) believe malls are only suitable for entertainment or hanging out, and just 3% said they have completely shifted to online shopping and see no relevance in visiting malls. These insights represent that while digital retail is expanding, brick-and-mortar locations still play a crucial role for many Indonesian consumers.

Things That Draws Indonesians to Shopping Centers in This Digital Era

This research identified four primary reasons why Indonesians still visit shopping centers. The leading motivation, cited by 39% of respondents, is shopping for personal or household needs. Shopping for specific items such as electronics, clothes, or shoes follows at 18%. Meanwhile, dining at restaurants or food courts was selected by 16%, and 15% visit malls to take a walk or relax. These findings suggest that shopping centers are evolving into multi-purpose spaces that combine retail, leisure, and lifestyle offerings.

What Does the Future Hold for Shopping Centers?

Looking ahead, 21% of respondents expect to shop at malls more often in the next one to two years. Half of the respondents indicated that their shopping habits would stay the same, neither increasing nor decreasing. However, 19% foresee themselves shopping at malls more rarely, while 4% claim they will stop going to malls entirely. An additional 7% are unsure about their future shopping behaviors. These trends point toward a stable short-term outlook for malls, but also emphasize the need for traditional retailers to adapt in the face of a gradually shifting consumer landscape.

While shopping centers in Indonesia are still relevant, especially for essential and social activities, their dominance is clearly being challenged by the rise of online shopping. To stay competitive, malls must reinvent themselves as hybrid spaces that combine retail, dining, and lifestyle experiences to meet the evolving needs of modern consumers.

For more information about this article, contact helena@snapcart.global or haifa.chairunisa@snapcart.global.

Looking to understand the reasons behind consumers’ changing behavior and explore possible solutions? Contact us at partners@snapcart.global.

Source:

[1] https://snapcart.global/the-fall-of-shopping-centers-in-indonesia-part-1/