Among its counterparts in Southeast Asia, Indonesia has one of the biggest and fastest-growing Fast Moving Consumer Goods (FMCG) markets. Even with the global inflation that has been occurring over the past several years, the market is still comparatively strong.

The increase in demands and changing lifestyle have been cited as some of the key drivers of market growth [1], particularly in the wake of the Covid-19 outbreak, when 78% of Indonesian consumers acknowledged that their habits and buying behaviour had altered [2].

However, since the boycott actions began around the end of October 2023, people’s behavior and buying patterns have also been impacted, even up to this day. Although boycotts rarely cause long-term economic losses, they have proven to be successful in damaging the reputation and brand image of targeted companies (Bhattacharya, 2004) [3].

Hence, in May 2024 Snapcart conducted research to discover FMCG market trends after the Covid-19 crisis has ended and during boycott actions in 2024. The study’s findings are listed below.

Indonesian Consumers’ Shopping Habit and Behaviour

The infographic above indicates some changes in Indonesian people’s shopping habit.

With 1.590 respondents that consist of 530 youngsters (Gen Z & Millennials age 28 – 29 y.o.), 530 females age 30+, and 530 males age 30+, we discovered that during Indonesian government’s regulations to impose widespread social restrictions (PSBB), online platforms are used to be Indonesians’ favourite place to shop FMCG products. However, just 10% of them who still become online shoppers for Fast Moving Consumer Goods (FMCG) in 2024. Nowadays, many people prefer to purchase these daily necessities at traditional markets.

In this survey, we figured out that price is the main factor for many of them to choose where to buy daily need products. Meanwhile those who still favour doing their daily grocery shopping online, however, acknowledged that the greatest online shopping platforms are chosen primarily because of their appealing promotions.

Aside from switching to shop offline, Indonesians also shop far more often in 2024, rather than during the Covid-19 outbreak. However, majority of them still set up similar budget to shop FMCG items since Covid-19 pandemic’s crisis times until this year.

The data on the infographic above also shows us people’s interesting shopping behavior, such as unlike during Covid-19 pandemic, most people are now reducing their consumption in health care products like vitamin, and they also buy medical mask less. Meanwhile in 2024, instant food remains the most popular FMCG category among people of all ages.

The Influence of Covid-19 Pandemic Toward Payment Method Trends in Indonesia

Cashless payment method has become viral since the occurrence of PSBB regulations in Indonesia.

Nevertheless, when we checked the truth from this trend, most of our respondents said that they love using cash during Covid-19 pandemic until present day. Many people who shop online still choose to pay using Cash on Delivery (COD) method rather than through bank transfer, debit/credit card, and paylater program.

FMCG Brand Footprint

In the fiercely competitive world of FMCG, there is a big possibility that people’s favourite brands are changing from time to time. Thus, we tried to figure out the most favourite FMCG brands that Indonesian people often use and/or consume for the last four years until present day.

According to the infographic at the beginning of this article, each FMCG category surely has a “Primadonna” brand amongst its consumers.

Since people do not just randomly consume and/or use a product, we asked our respondents about how they choose an FMCG brand to buy, and we found out that brands with an affordable price are far more appealing than the popular ones.

Boycott Actions

The conflict between Israel & Palestine has made the boycott actions go viral all over the world. Starting at the end of 2023, many people are still joining this actions until the present day.

According to the General Chairperson of The Indonesian Retail Entrepreneurs Association (Aprindo), FMCG products have been affected the most by this boycott actions, that the decline level in FMCG sales turnover has reached down to 40% [4]. To figure out further from the consumers’ point of view, we also asked our respondents about this phenomenon.

As represented on the infographic above, 46% of the population stated that they are joining the boycott actions, 51% of them are potentially doing this action temporarily, whilst the rest of them are not using/consuming the boycotted brands anymore forever because they have already comfortable with other brands which they use as a substitution at the beginning of their action.

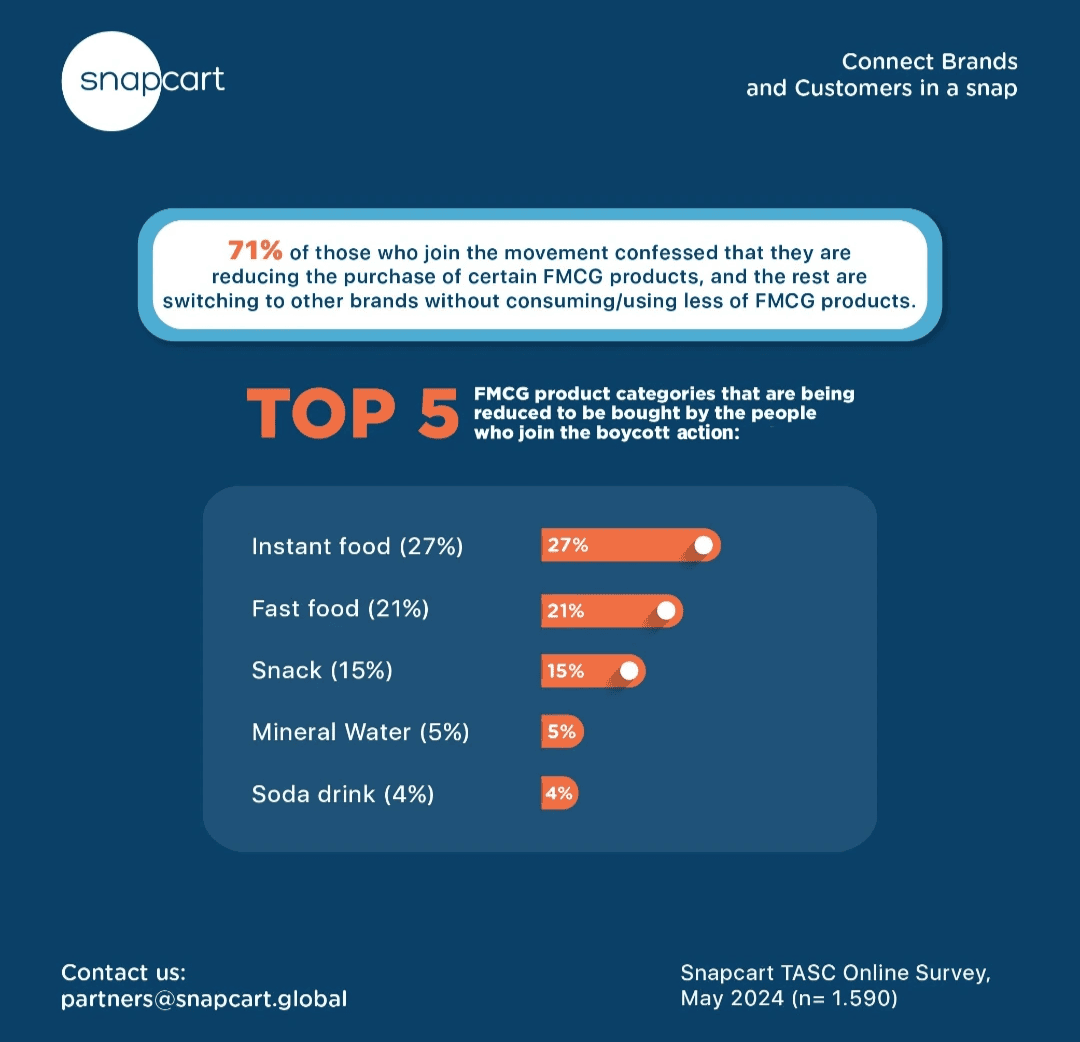

Whereas 71% of people said that instead of doing the brand switching, they try to reduce the purchase of certain FMCG products as their effort to join this boycotting action. Despite instant food always being the best-selling products in various FMCG categories, we figured out that many people also try to reduce their food consumption as an effort to join this boycott actions.

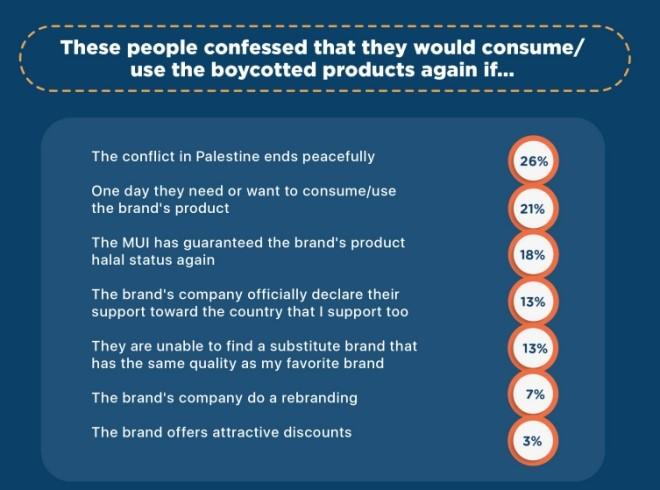

Moreover, meanwhile many boycotted companies offer attractive discounts and even do a re-branding to get their consumers back, our study found that these ways only attract 10% of them to stop boycotting. In fact, majority of them said they would use the boycotted brand again after the conflict in Palestine ends peacefully. You can check the detailed data on the infographic above and graphic below.

Need to discover the newest market trends or find business solutions by asking consumers directly to discover what they need and desire? Contact us at partners@snapcart.global .

Sources: