In the first part of this article, we discovered that in 2025, health insurance remains a vital consideration for Indonesians, that a significant portion of the population has embraced it as a safeguard against medical uncertainties [1].

Hence, what influence Indonesians’ choices when it comes to this service?

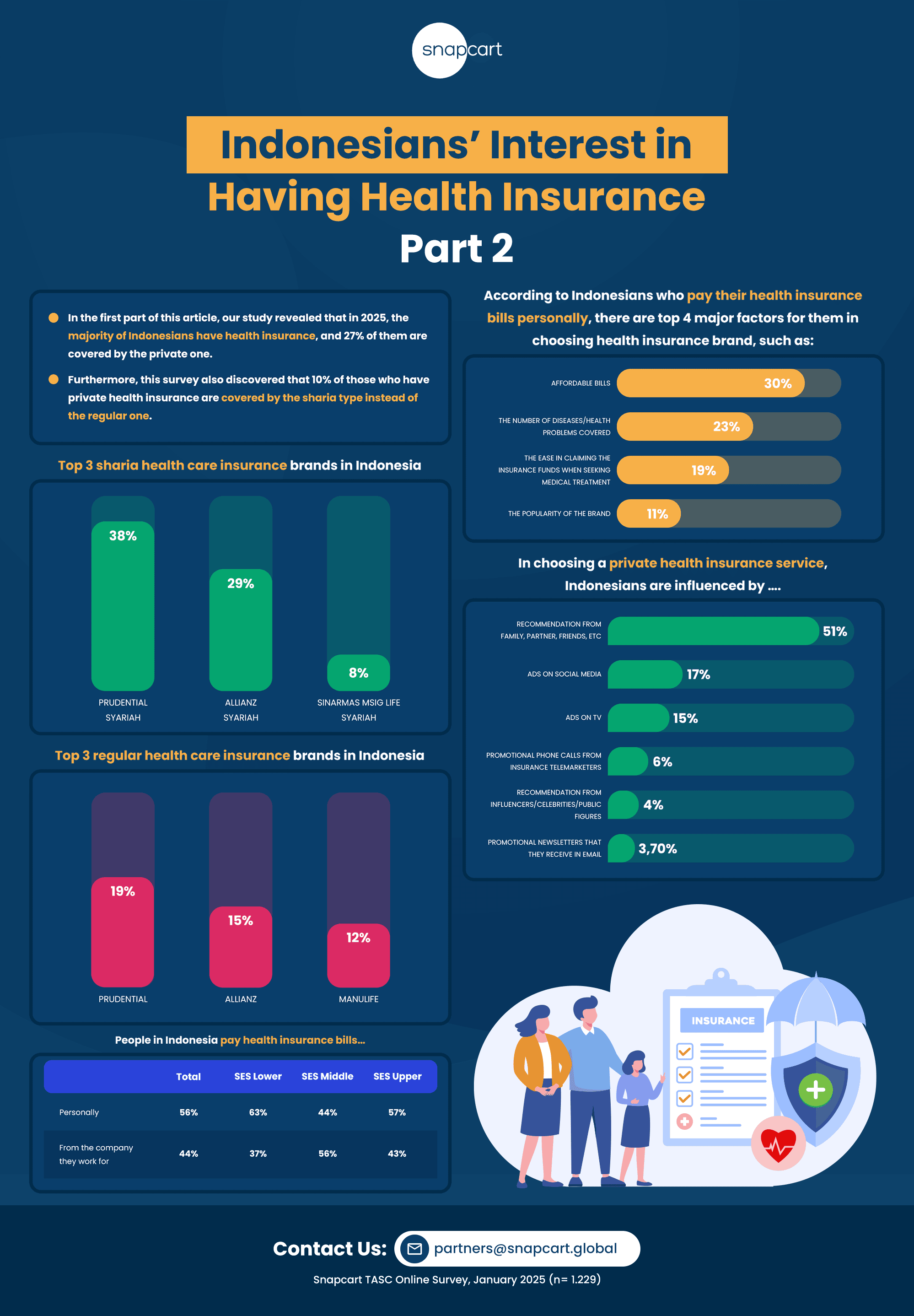

In this study, we found out that 27% of Indonesians are opting for private health insurance, meanwhile the rest prefer to be covered by the national health insurance program like BPJS/JKN only [1].

Interestingly, 10% of those who have private health insurance prefer to be covered by the sharia-compliant service one, which aligns with Islamic financial principles. And among the sharia health insurance providers, three brands stand out:

- Prudential Syariah – 38% of respondents chose this provider.

- Allianz Syariah – Preferred by 29% of respondents.

- Sinarmas MSIG Life Syariah – Chosen by 8% of respondents.

On the other side, for those who prefer regular health insurance, the top brands are:

- Prudential – 19% market preference.

- Allianz – Selected by 15%.

- Manulife – Garnered 12% preference.

Factors in Choosing Health Insurance Service

This research discovered that 56% of Indonesians pay for their health insurance service(s) bills personally, with 63% from the lower SES, 44% from the middle SES, and 57% from the upper SES. And when they personally pay for their health insurance premiums, their decision-making process in choosing health insurance brand is influenced by the following factors:

- Affordable Bills (30%) – Cost remains a primary consideration.

- Number of Diseases/Health Problems Covered (23%) – Comprehensive coverage is a critical factor.

- Ease of Claiming Insurance Funds (19%) – Smooth claim processes are highly valued.

- Popularity of the Brand (11%) – Brand reputation plays a role, though less prominently.

Furthermore, 51% of our respondents also revealed that when selecting private health insurance services, they rely heavily on recommendations from their closest people like family, partners, and friends, meanwhile the rest …

- Social Media Advertisements (17%) – Digital marketing plays a significant role.

- Television Advertisements (15%) – Traditional media remains relevant.

- Promotional Phone Calls (6%), Celebrity Endorsements (4%), and Email Newsletters (3.7%) – These methods have a minor influence.

All in all, whether driven by affordability, comprehensive coverage, or the ease of claims, Indonesians prioritize financial and social factors when selecting their insurance providers. With a strong reliance on recommendations, the health insurance landscape in Indonesia continues to adapt to the population’s diverse needs.

Source:

[1] https://snapcart.global/indonesians-interest-in-having-health-insurance-part-1/