In line with President Jokowi’s policy to carefully reopen the economy, a series of gradual directives on relaxing large-scale social restrictions (PSBB) has been implemented in the first week of June.

Over a month has passed since then and the social restrictions have been relaxed one after another. How is the market reacting to it?

Waning Fear of COVID-19?

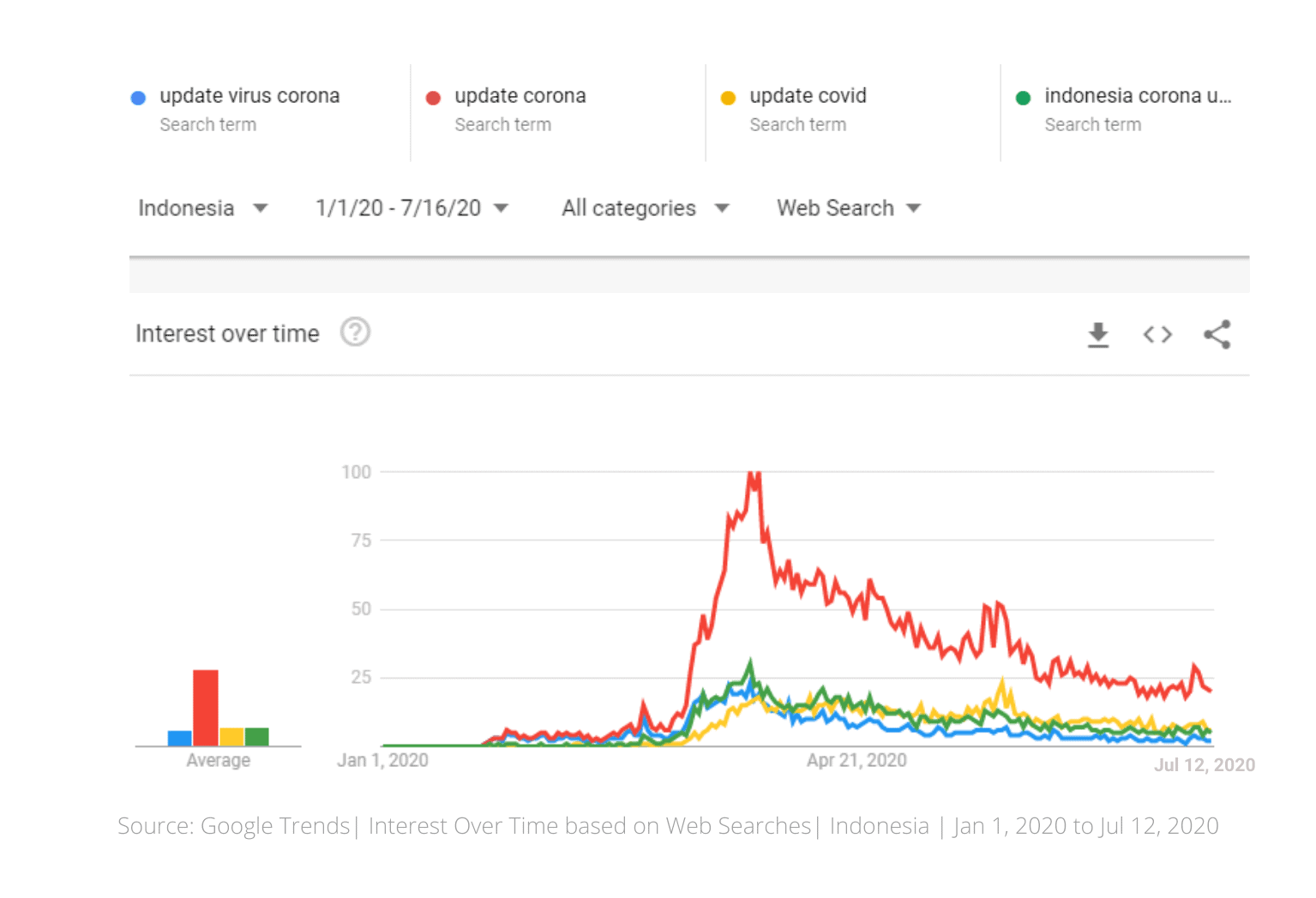

Looking at the popularity of search words related to getting updates on the COVID-19 situation in Indonesia using Google Trends, a drastic decrease in interest on the matter can be seen after it peaked in the last week of March 2020.

This indicates a decreasing public wariness against the virus as less and less Indonesians kept on checking for updates on the COVID-19 status in the country.

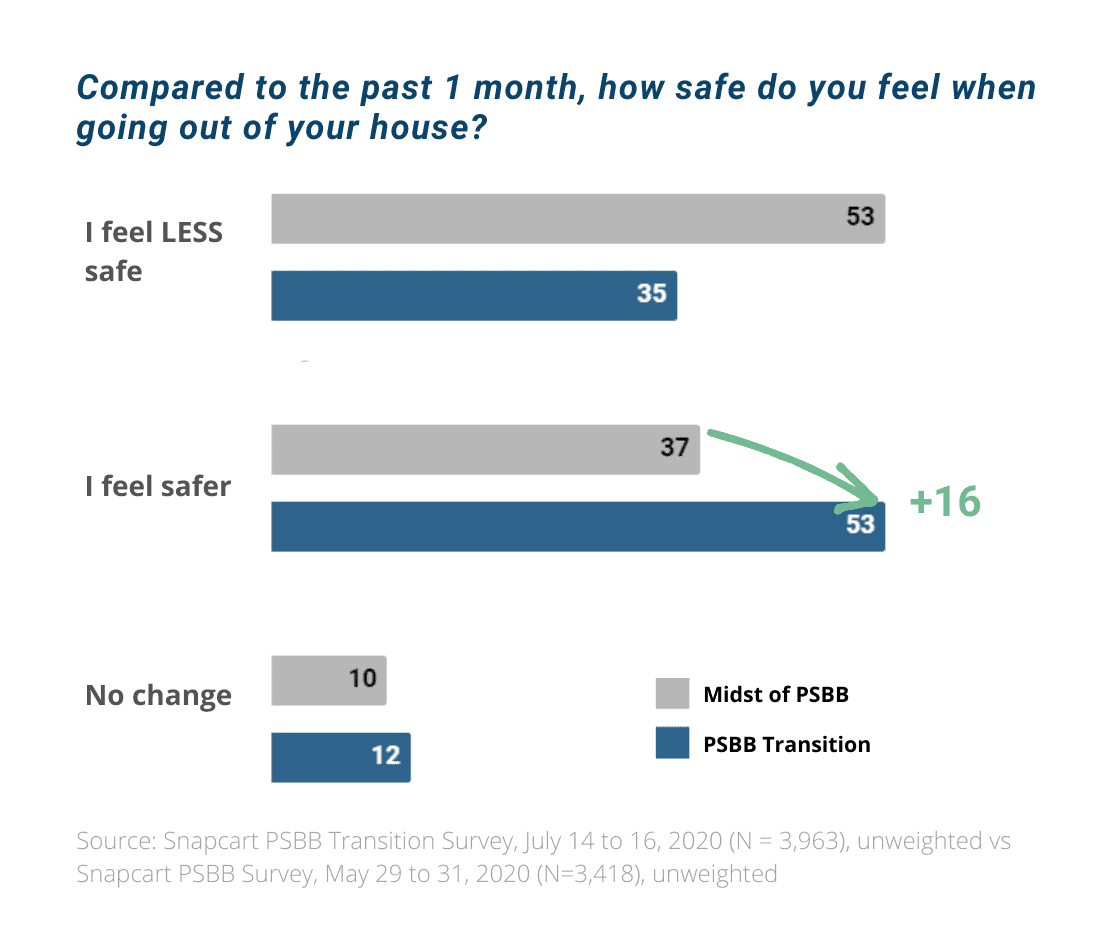

Snapcart’s latest survey result (July 14 survey) on Indonesian perception towards transitional PSBB agrees with this indication as majority of Indonesians feel safer now compared to the days before the first reopening of the economy (May 29 survey) when the prevailing attitude towards the pandemic among the public was more cautious.

In the older survey, only 37% of the respondents claimed that they felt safer going out of their houses. Now, those who claimed to feel safer climbed to 53%, while those who felt less safe have dropped from 53% to 35%.

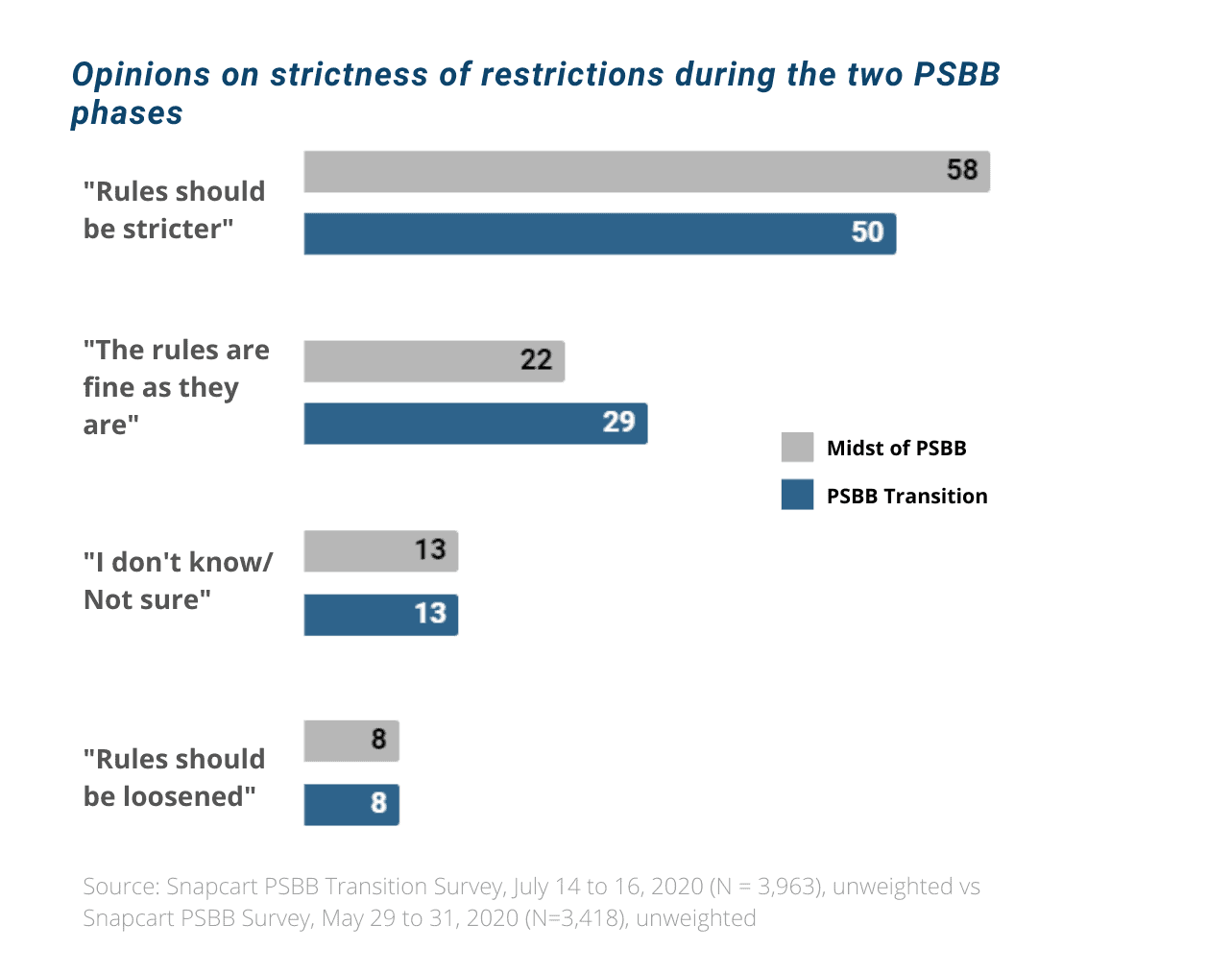

When asked about what they think about the restrictions implemented in two different instances (May 29 vs July 14), more Indonesians, from 22% to 29%, now feel that the current restrictions are just fine as they are and have no need to change. While those who think that the restrictions should be tighter are still the majority, the percentage of people believing that dropped from 58% to 50%.

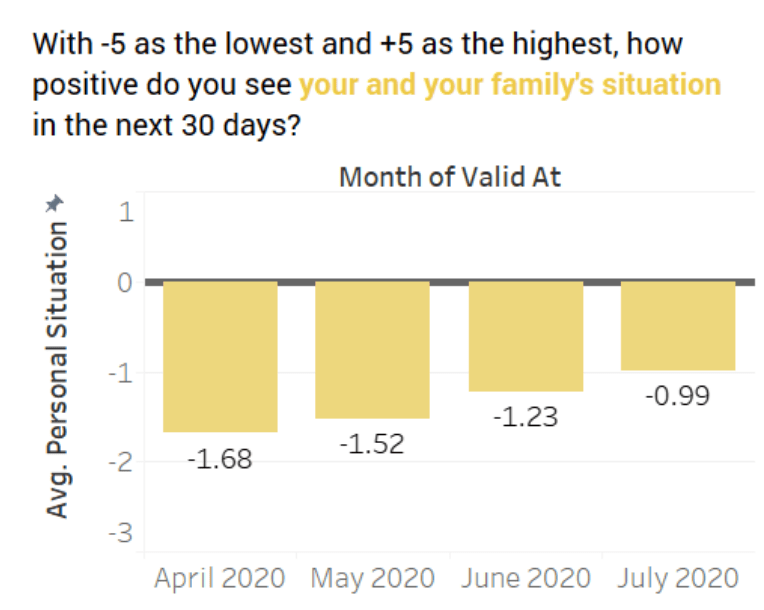

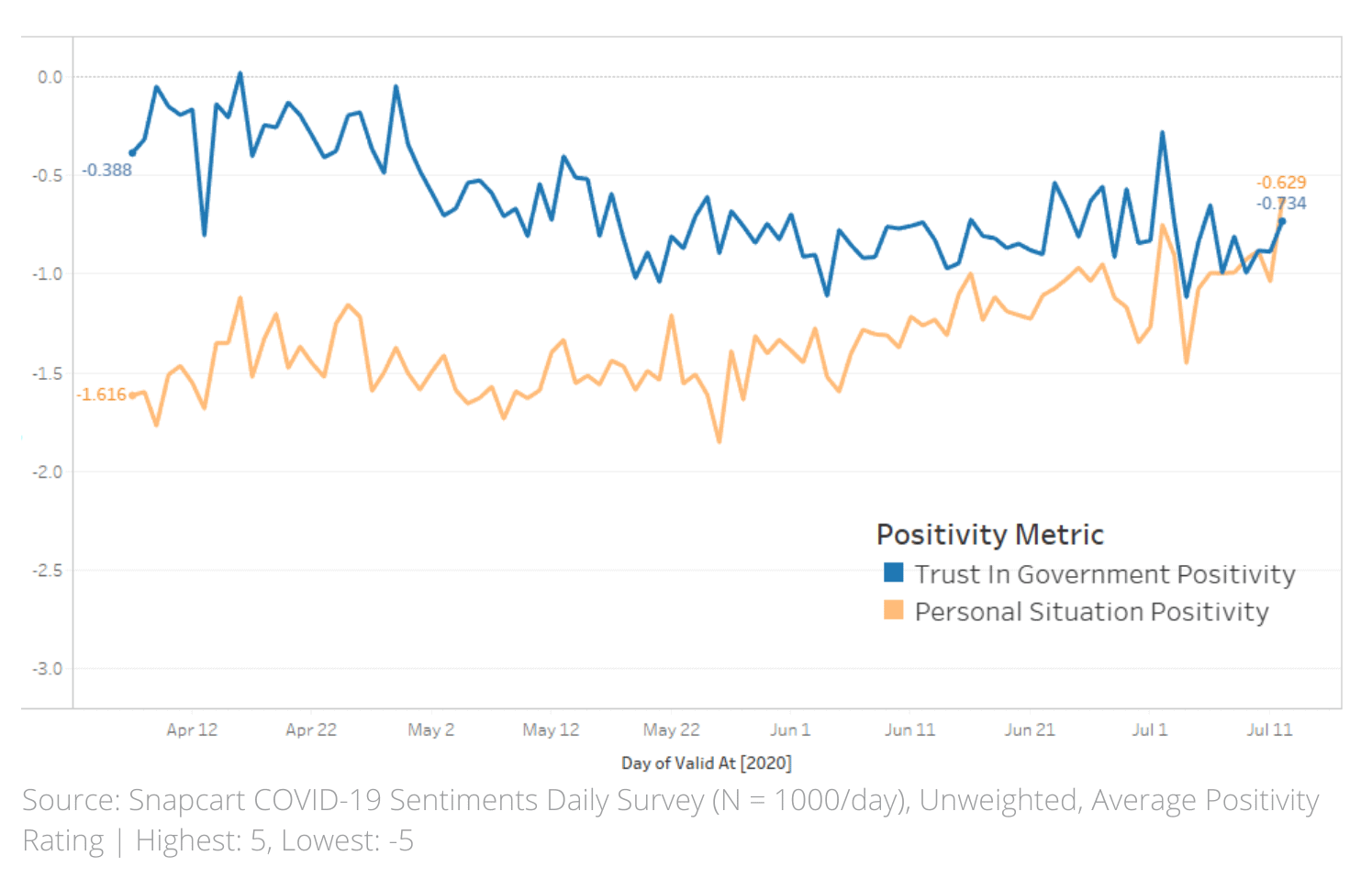

According to another Snapcart survey on shopper sentiment on Indonesians’ personal and family situation with regard to it being impacted by the COVID-19 pandemic, the average sentiment has been improving starting with a negative score of -1.68 (highest: 5, lowest: -5) on April 2020, to having -0.99 average score in June, still in the negatives, but a significant improvement from April.

Changes in Shopping Behaviour

With the majority of Indonesian shoppers being less wary of COVID-19, and feeling safer to go outside their homes, businesses are now able to recuperate losses from the months of economic and social lockdown.

In March 2, President Jokowi announced the first two COVID-19 cases in the country which has included Indonesia to the then growing list of countries waking up to the grim possibilities the pandemic will bring to their own countries. This has incited panic buying or at the very least, people stocking up on grocery items as fear of shortage in supply reached the population.

In April, the wide-scale social restriction policy (PSBB) was implemented, and people learned to adjust to the new rules. This has caused several sectors, including retail, to see their April sales dropped dramatically. This steep decline then proceeded to give an even grimmer forecast for May 2020.

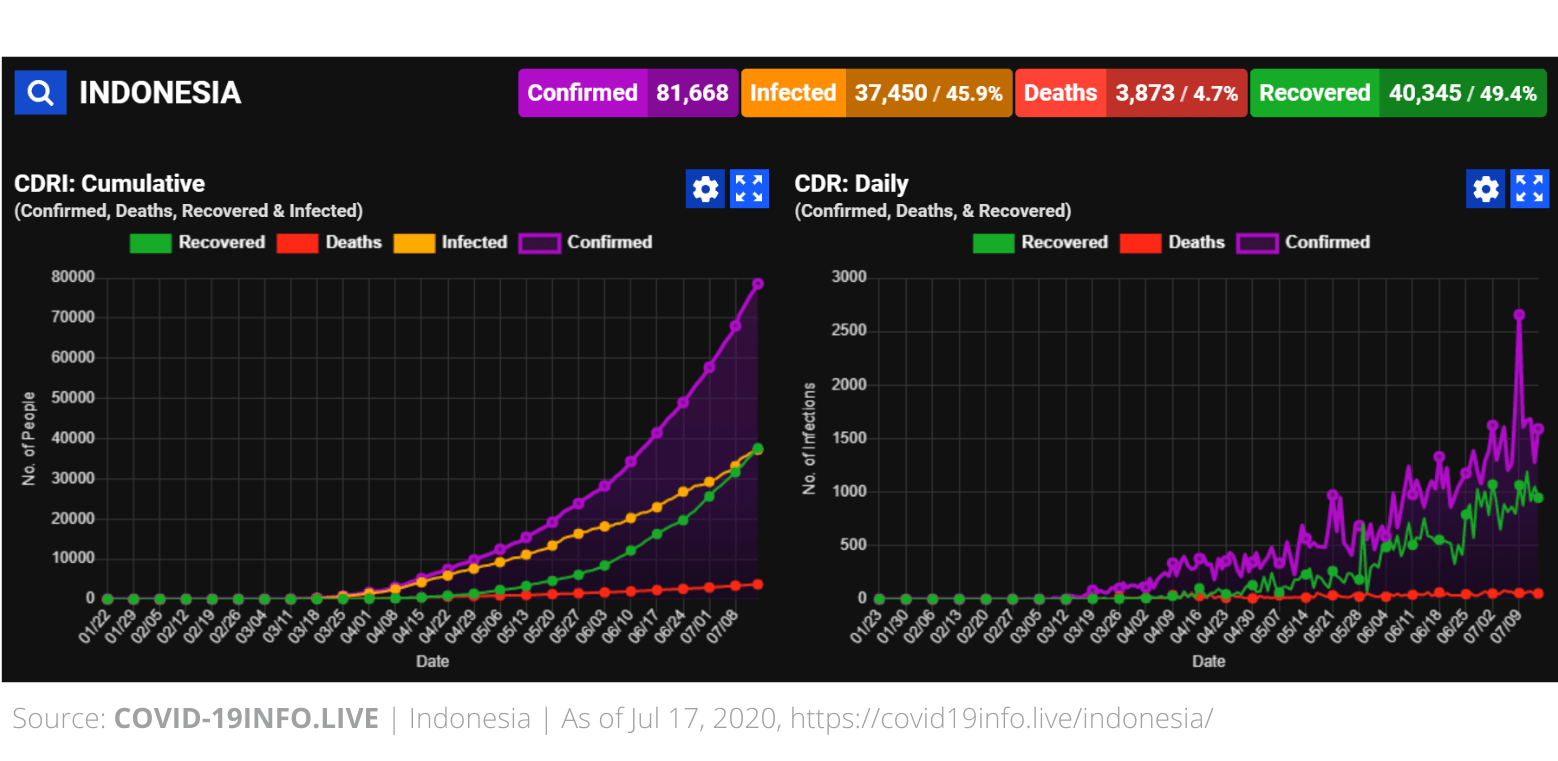

In the first week of June 2020, the Indonesian economy reopened with more establishments allowed to operate again, but maintained a level of social restriction as Indonesia’s confirmed COVID-19 cases showed no sign of slowing down in terms of daily new cases.

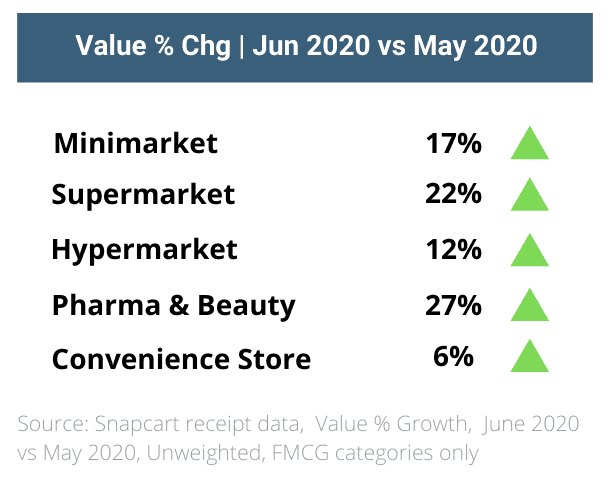

Sales Growth in June 2020

Despite the number of new cases hitting new record highs every few days, it is also by this time that the general public sentiment on the risks of the pandemic have become more positive, and more and more people feel safer to do outdoor activities than how they felt months before.

The reopening of the economy and people’s greater confidence in their safeness to participate in economic activities are likely contributors to the fast improvement of value sales for all store formats in June 2020 compared to the month before.

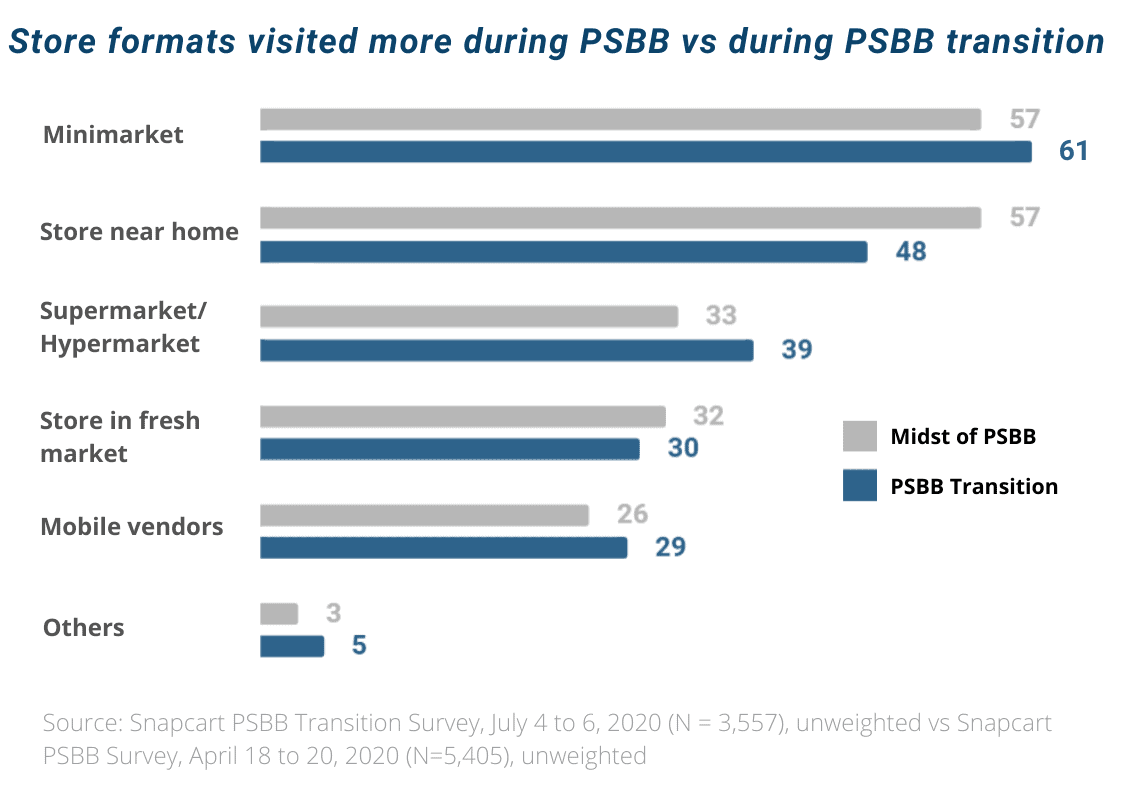

Traveling farther for shopping

Another shopping phenomenon that changed very recently is the store formats visited most often. In July 2020, during the PSBB transition, there is more percentage of Indonesian shoppers who visited store formats a bit farther from their homes such as minimarkets, supermarket/ hypermarket, and mobile vendors. Those who visited stores near home declined in percentage from 57% to 48%. This indicates that Indonesian shoppers have gotten more confident to travel farther away from their houses as they are now less worried about contacting the virus.

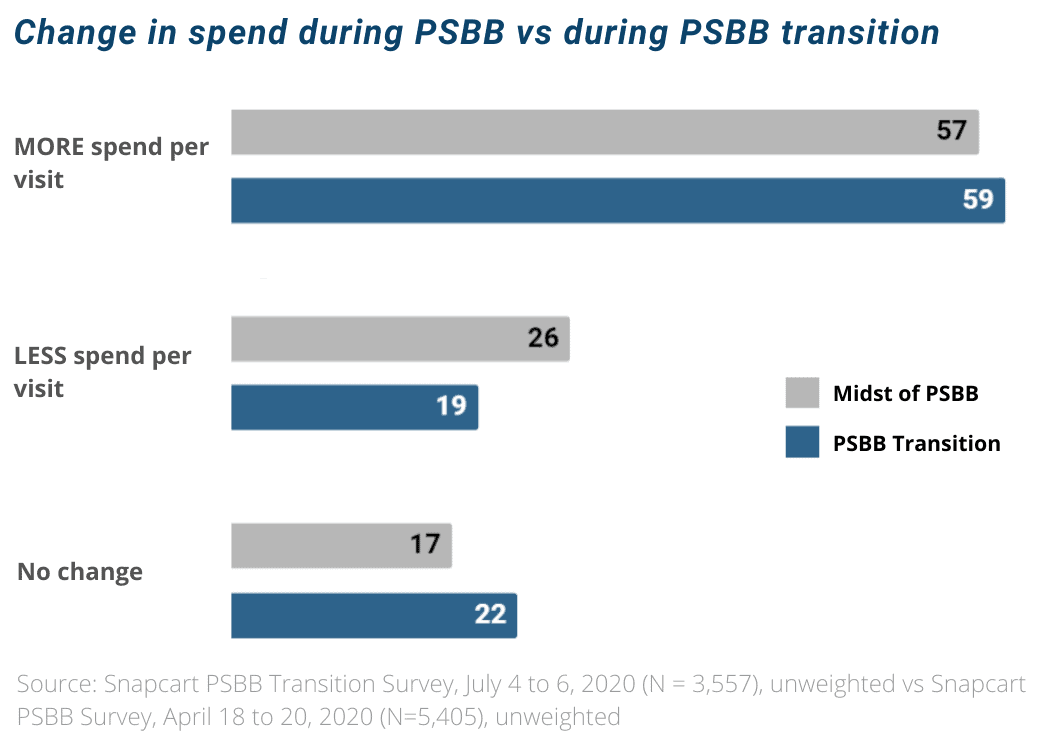

Bigger Spend per Store Visit

Not only were they more confident to travel farther, but they were also more confident to spend more per store visit. People who spent more per visit because of the pandemic increased from 57% to 59%, and those who spent less amount per visit decreased from 26% to 19%.

More people also had more purchases within high price ranges for groceries per visit during the transition compared to the during PSBB midst. Moreover, less people are spending within the lower amount per visit ranges on grocery expenses.

Non-Food, ‘Less Essential’ Categories Growth

Aside from the farther travel for shopping and higher spend per visit as effects of the increasing public confidence on their safeness against the pandemic when doing outdoor activities, consumer purchases in terms of items bought has also observed a trend change.

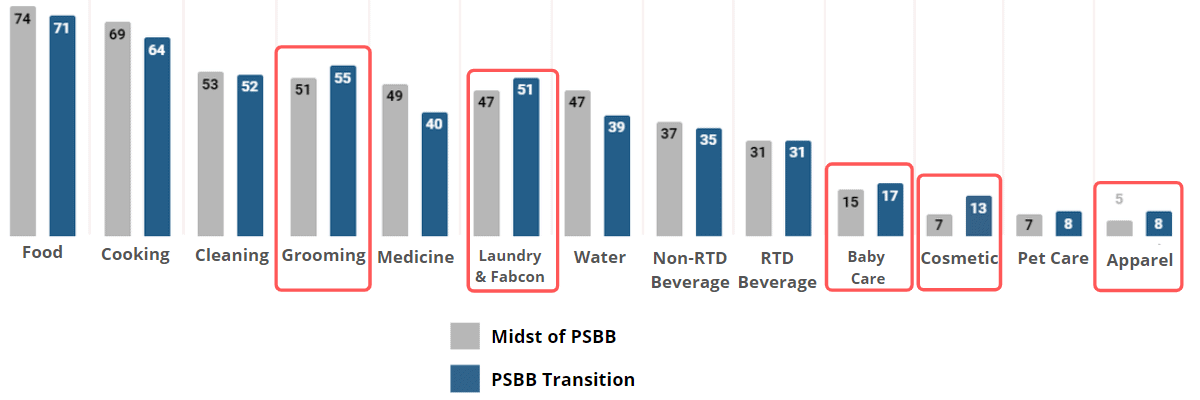

During the latest PSBB transition, an increase in the percentage of Indonesians who bought more of categories that can be considered less essential compared to food, water, and medicine was observed, according to a survey comparing grocery items bought more during the two different phases of PSBB. These categories include grooming, laundry, baby care, cosmetics, and apparel.

Meanwhile, ‘more essential’ categories such as food, cooking, medicine, and beverages see decline in shoppers who are buying more of them during the latest PSBB phase. Further studies on the reason for this event is recommended. Two hypotheses to test are

- As consumers feel more secure now in the situation, they feel less anxious to stock up on ‘essential goods’.

- As other establishments reopened, consumers who used to purchase all of their needed categories in grocery stores are now purchasing from other channels such as restaurants and food stalls.

What has not recovered yet?

Travel

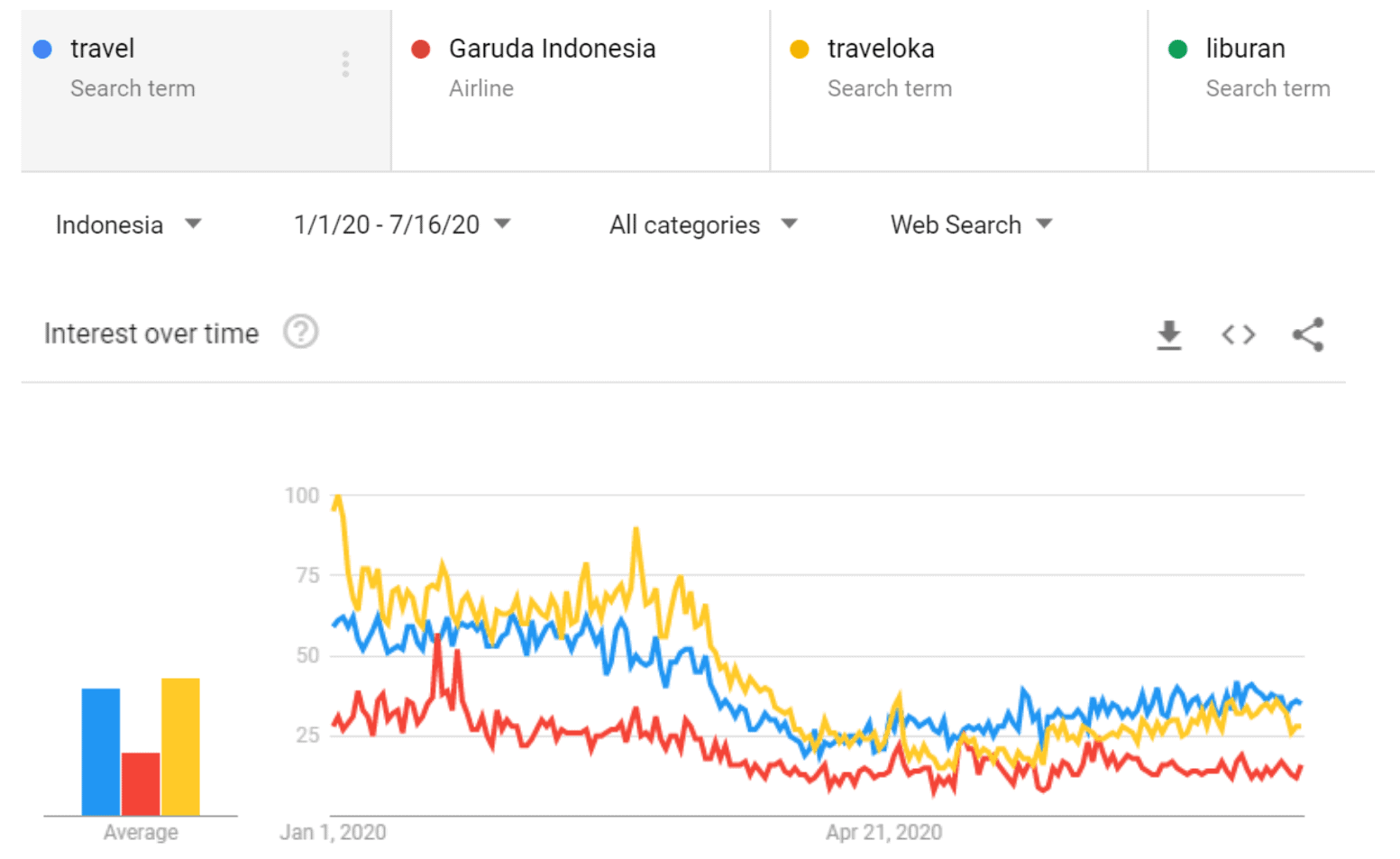

Indonesia’s flag carrier airline, Garuda Indonesia, still has low passenger numbers despite the easing of restrictions. Its president director, Irfan Setiaputra, reported that “the number of passengers is still down more than 90 percent, and 70 percent of its aircraft remain grounded”.

In terms of web search interest, common travel-related search words’ popularity still has not recovered from the slump that started mid-March despite the economy reopening and despite government and private efforts to boost travel and tourism such as reopening travel spots like Bali and opening tourist activities with strict health protocols.

Public Perception of Government Handling of COVID-19 situation

Although Indonesians think that their personal and family situation has improved over the months, their perception of how the government and health authorities are handling the COVID-19 situation in Indonesia has been plummeting. Even if it started having better average positivity perception from the public compared to their personal situation prospect, trust in government to handle the crisis effectively has been falling over the months.

Hey there! Do you have a business question in mind for your category that you want to see a study on like the topic above? Please email me at partners@snapcart.global about your topic of interest. I am currently searching for interesting topics for our next articles. Looking forward to hearing from you soon!

Or click here to schedule a meeting.