One of the most impacted sectors of the social restrictions imposed during the pandemic is the hospitality industry. Almost all businesses in lodging, food and drink service, event planning,

theme parks, and transportation either had a drastic slowdown in business or had already stopped operating permanently.

This sudden shut-down of the hospitality industry, among other reasons, has left people to have a lot of time to spend indoors. This has given a sharp rise to time spent on indoor activities such as playing video games, web surfing, and streaming.

One interesting activity that has also received a lot more attention during the lockdown is home cooking.

The Rise of Interest in Home Cooking in Indonesia

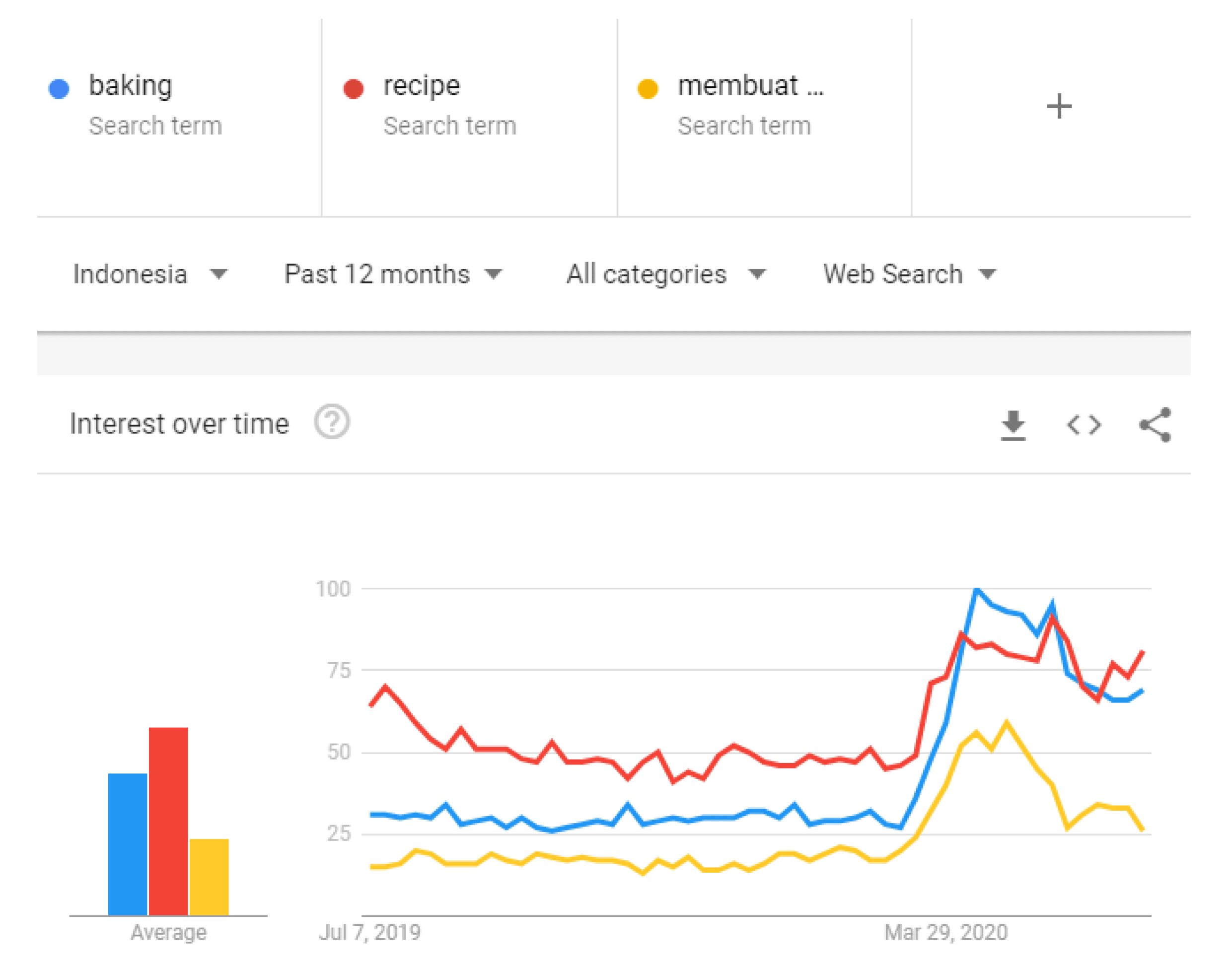

According to Google Trends data, web search keywords “baking”, “recipe”, and “membuat roti” suddenly gained popularity starting March 15, and peaked around the third week of April 2020.

Meanwhile, the popularity for the search word “resep” stayed longer and peaked 1 month later around the third week of May 2020.

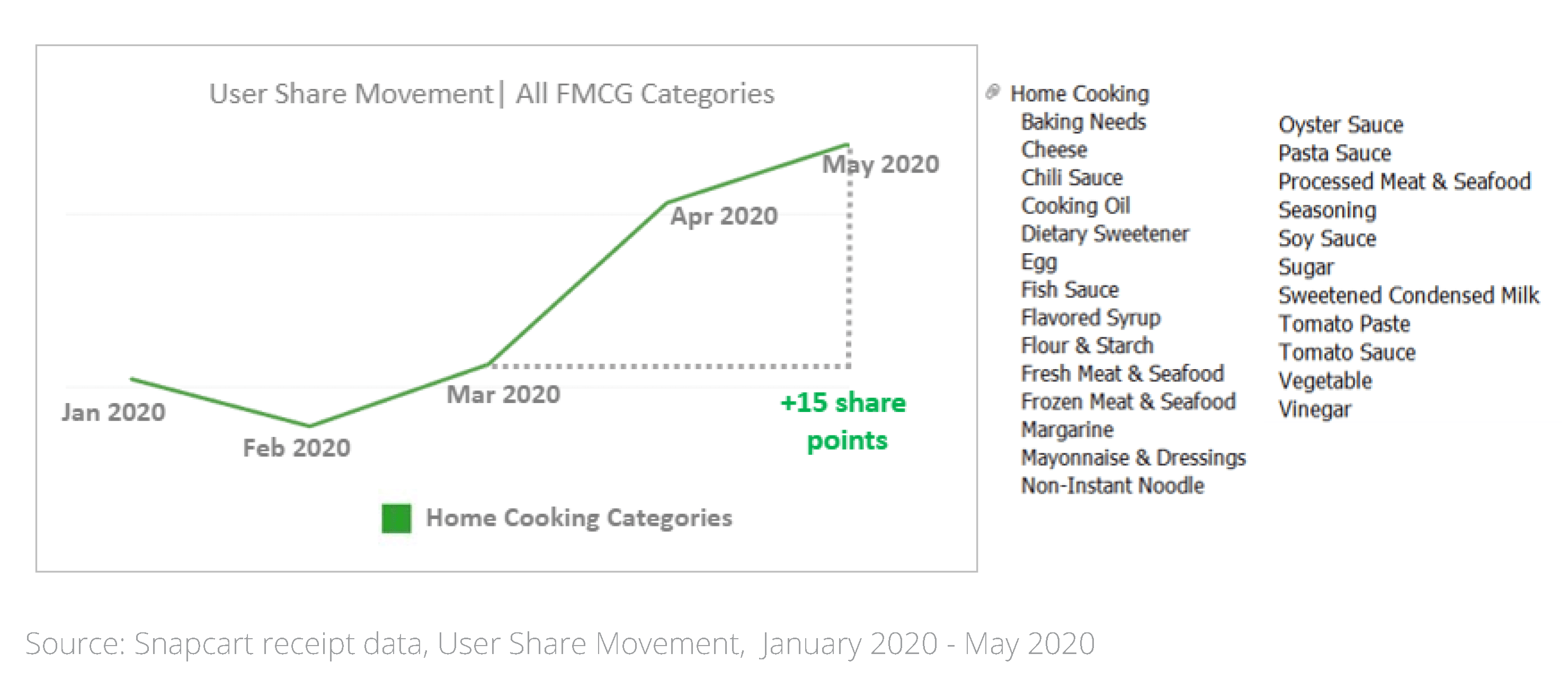

Snapcart’s receipt purchase data agrees with this trend as categories under ‘Home Cooking’ were seen to gain almost 15 share points within just 2 months from March 2020 to May 2020 which was an unprecedented event in that group of categories.

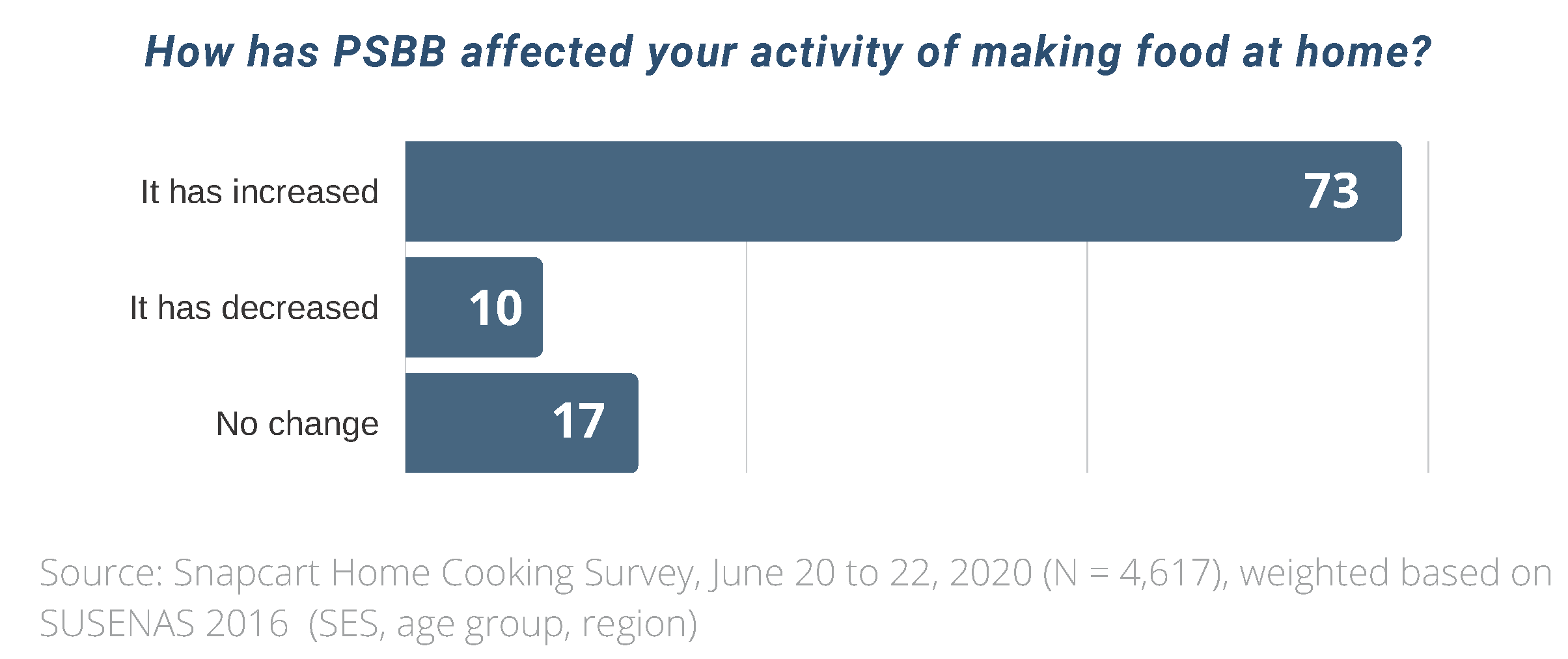

The trend is also aligned with Snapcart’s survey data on over 4,500 respondents on their food preparation activities at home. A huge majority (73%) of them claimed that their food making activities have increased in the past 3 months during the PSBB.

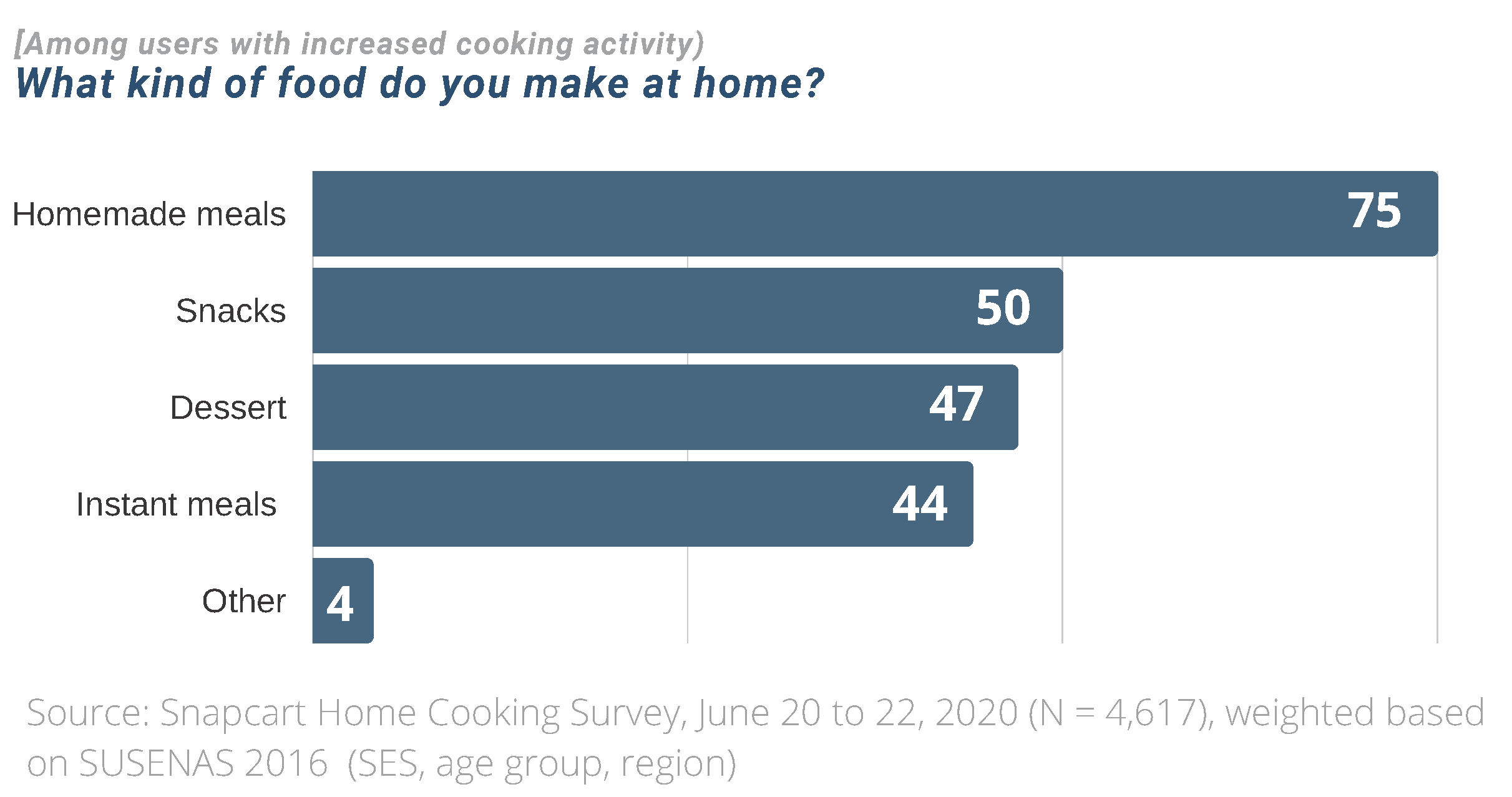

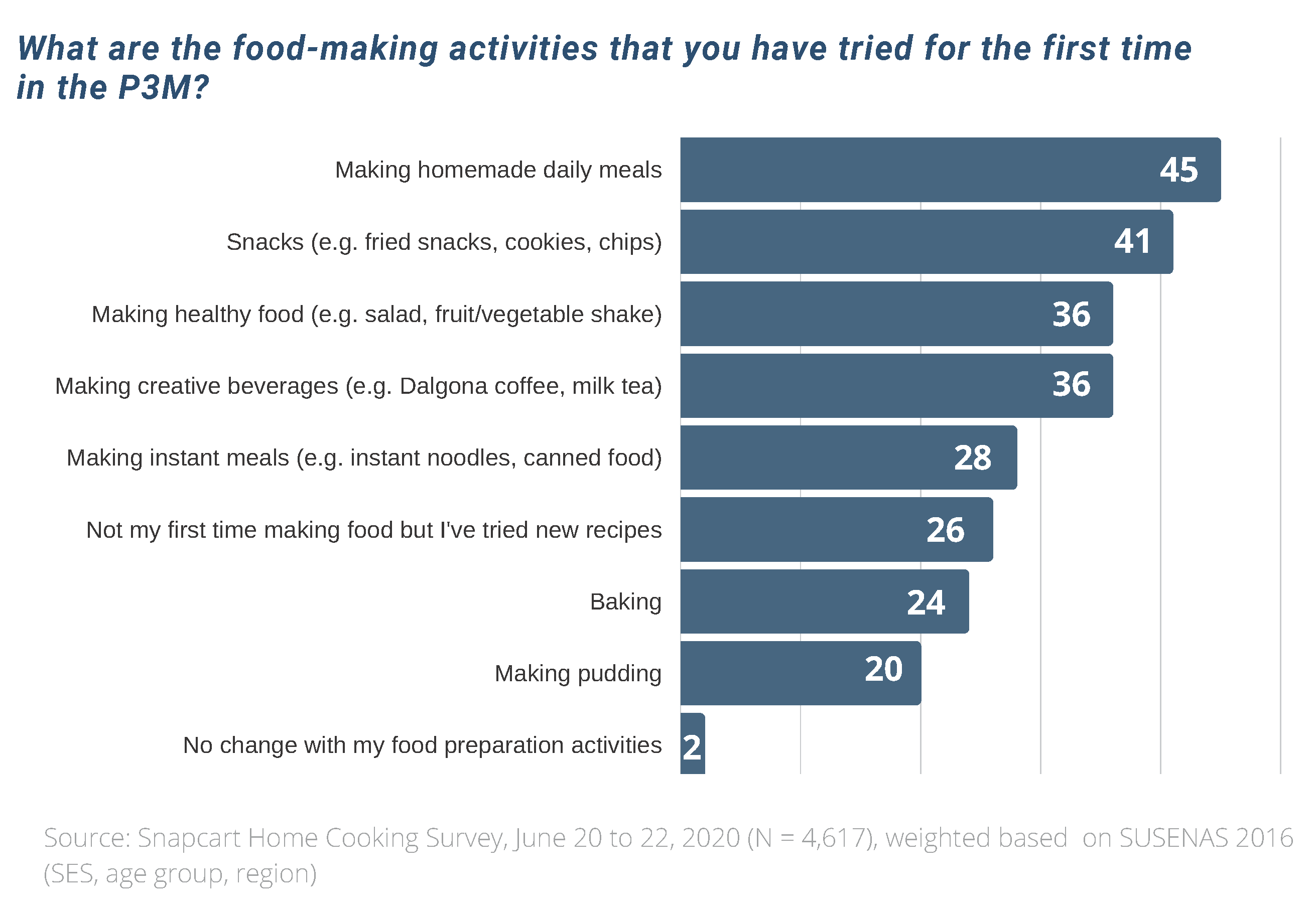

75% of the respondents who have increased their food making activities in the past 3 months make homemade meals (breakfast, lunch, dinner meals cooked from fresh ingredients). Foods such as snacks, dessert, and instant meals, despite not being part of the daily main meals, have 44%-50% of the respondents preparing for them.

After daily main meals, snacks come as the second most prepared food among those who have increased their food making activity. Trendy creative beverages, such as the Dalgona coffee and boba tea, get tied in the third place alongside preparing healthy snacks and beverages.

Interestingly, only 2% did not try for the first time making any kind of food that is new to them during PSBB.

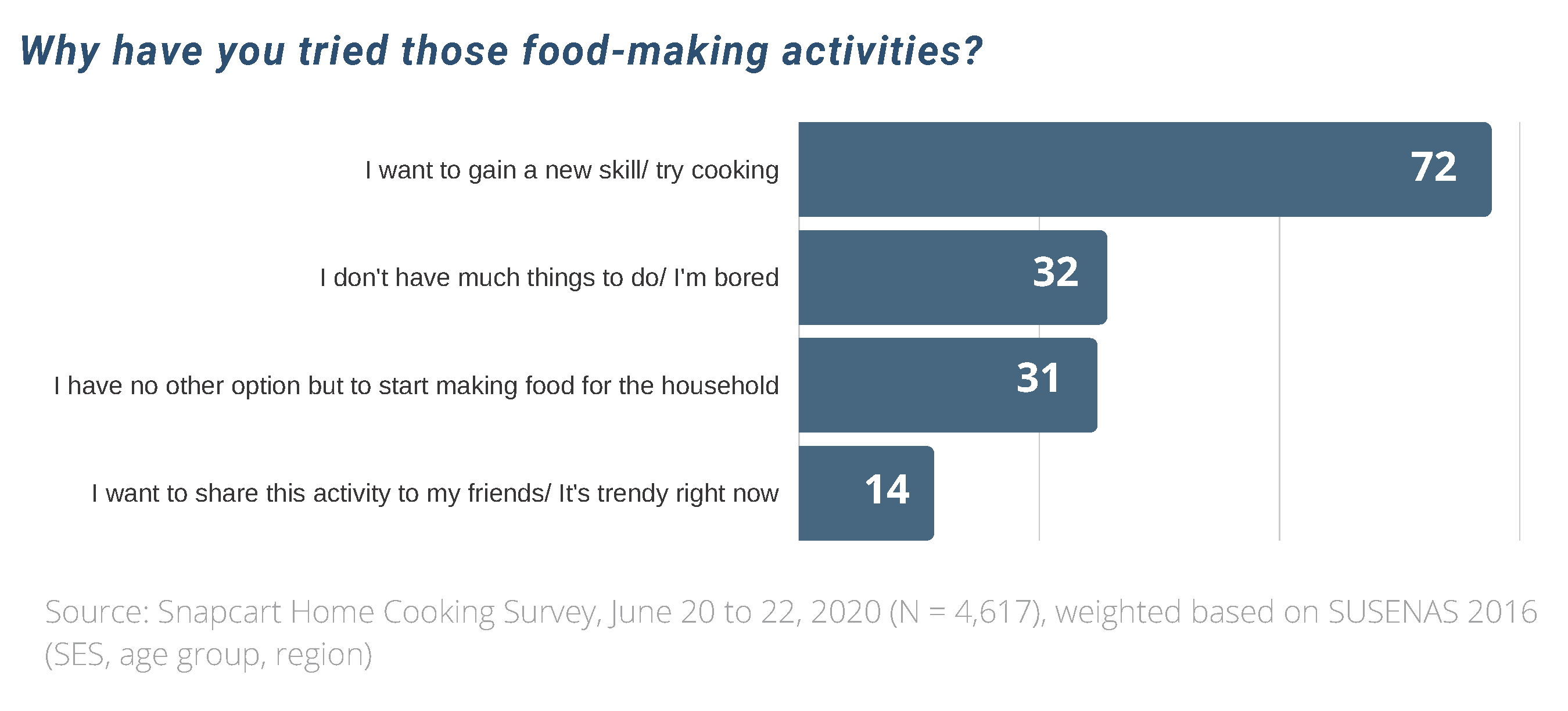

Among those who have tried making either new recipes or new types of food for the first time during PSBB, the top cited reason for trying to do so was the want to gain new skill in food-making or just doing the activity just for the sake of trying it.

Temporary Growth vs Continuous Growth

Trends come and go. Before making any business decisions based on trends, it is always important to know what in a trend is temporary and what is going to continue long enough to bet business decisions on them.

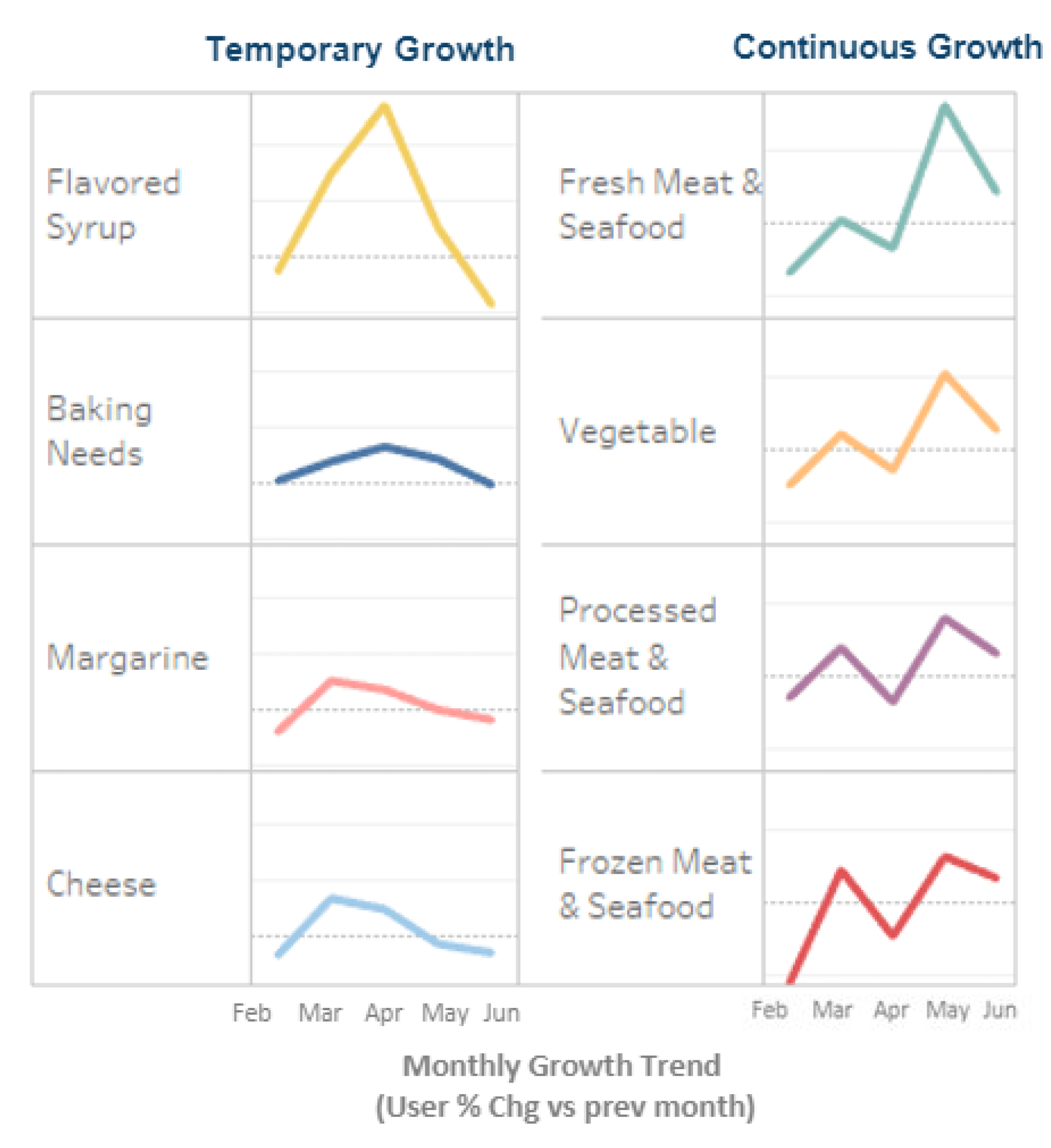

For example, the categories below under Home Cooking show two different kinds of growth during PSBB. The first kind, the temporary kind, peaked some time in April or May due to food trends on baking, and making desserts and snacks. In June, just a few months after the peak, a drastic drop in growth is already occurring.

The second kind, the continuous kind, peaked in May, but not due to any fad on food making. In June, a growth slowdown can be seen but even with slower growth compared to previous months, its June growth is still high compared to pre-pandemic times. If you look at the example categories for continuous growth, you will see those categories are used for more common types of foods than the ones for temporary growth which have only spiked in growth because of the fads in food creation during the pandemic.

Taking Advantage of the Trend

Having knowledge of the trend in mind, what can one do to take advantage of it?

If you have food brands in the FMCG sector, you most likely have already seen the size of your category’s pie expand within 2 months what it normally takes years to achieve the same growth.

If you are in the food FMCG division but are not expanding as much as the category leader, here are some recommendations to take advantage of this change in trend.

Know how the playing field has changed. Before making any new business decision related to this trend, know first how this changed for your category, your brand, the market’s demand, and changes in the supply chain. You should be able to imagine where your product comes in your target market’s daily lives and if you now have a bigger or smaller part in it as a result of the changes that happened this year.

Tailor your ads and promos to align with the new trend

- Bundling. As seen in the earlier charts, FMCG categories used for cooking daily meals have been able to sustain high growth in June. These are the categories most likely to continue growing or at least maintain the current sales level even as the world continues to normalize. If it is applicable for your product to bundle with a category with continuous growth as a promo, your product may benefit from this other product’s high growth. For example, your product + free seasoning pack.

- Ads showing your product’s relevance in the new normal for food. Tailoring your product’s advertising efforts to show how it can help new needs corresponding to the new normal for cooking can help your target market imagine easier how your product can fit their new cooking routine. Aside from new needs, aim to find new wants that can be generated from the changes in cooking routines.

Shelf placement. Knowing where your product stands in the “new normal”, you can take advantage of strategic shelf placement. Learn about which products, brands, and categories have the highest affinity* to your product and have your product placed in a strategic location close to it.

Want to know which products have the highest affinity to your category? Contact us to find out!

*Product Affinity: tendency of a product to be bought together with another product in one store visit.

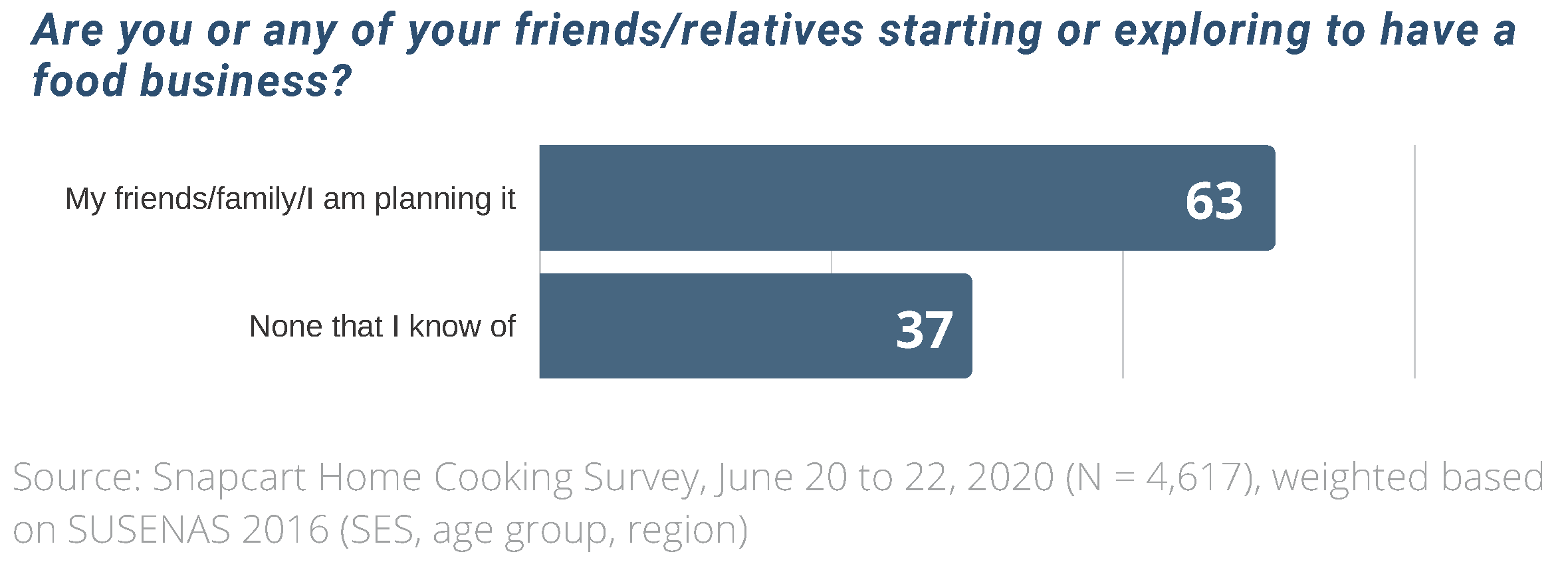

Watch out for new trends in food. According to a Snapcart’s survey on home cooking trends, the majority (63%) of respondents are planning or know someone who is planning to start a food business. This could be in response to people seeking out new ways to earn money while staying at home. Be on the lookout for the development of this trend and any other new trend emerging.

The Food Industry in the Near Future

The following factors affect the future of the trend in the food industry:

Restaurants. As restaurants and other outdoor food businesses closed during PSBB, food grocery manufacturers had to hurry to increase their supply to fill in for these closed establishments’ parts of the pie in total food demand. How fast restaurant-goers go back to their old frequency of going to restaurants will affect this supply void left by restaurants to food grocery manufacturers. In the present, restaurants have opened but are still not operating in 100% capacity to implement social distancing protocols, slashed “unimportant” items in their menus to cut cost on wasted ingredients, and still does not have the same customer demand it used to enjoy pre-pandemic as many people are still worried about the safeness of eating outdoors alongside many other people.

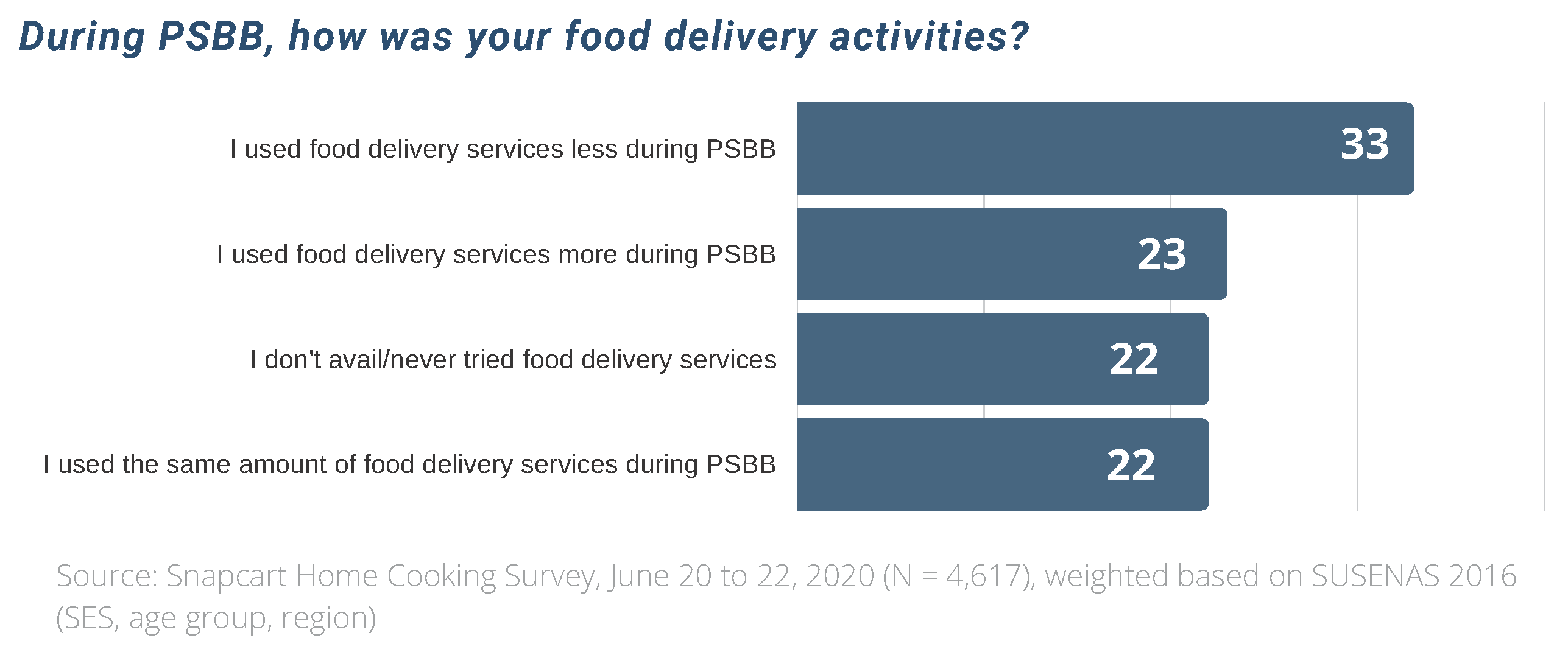

Food delivery. Food delivery services have supplied consumer demand unmet by restaurants as they were shut down or restricted to operate at maximum capacity. According to a Snapcart survey, 23% of consumers claimed to have increased their use of food delivery service during the PSBB. However, at a greater percentage at 33% are consumers that claimed to have actually decreased their use of food delivery services during PSBB. While we do not have an exact figure on the overall impact of the lockdowns on food delivery businesses as a whole and what kinds of consumers have decreased or increased their food delivery activities, we can assume that the 33% who used the service less have shifted to grocery food products that they can prepare to make at home. Further studies on food delivery service consumption can guide your assessment of the market further.

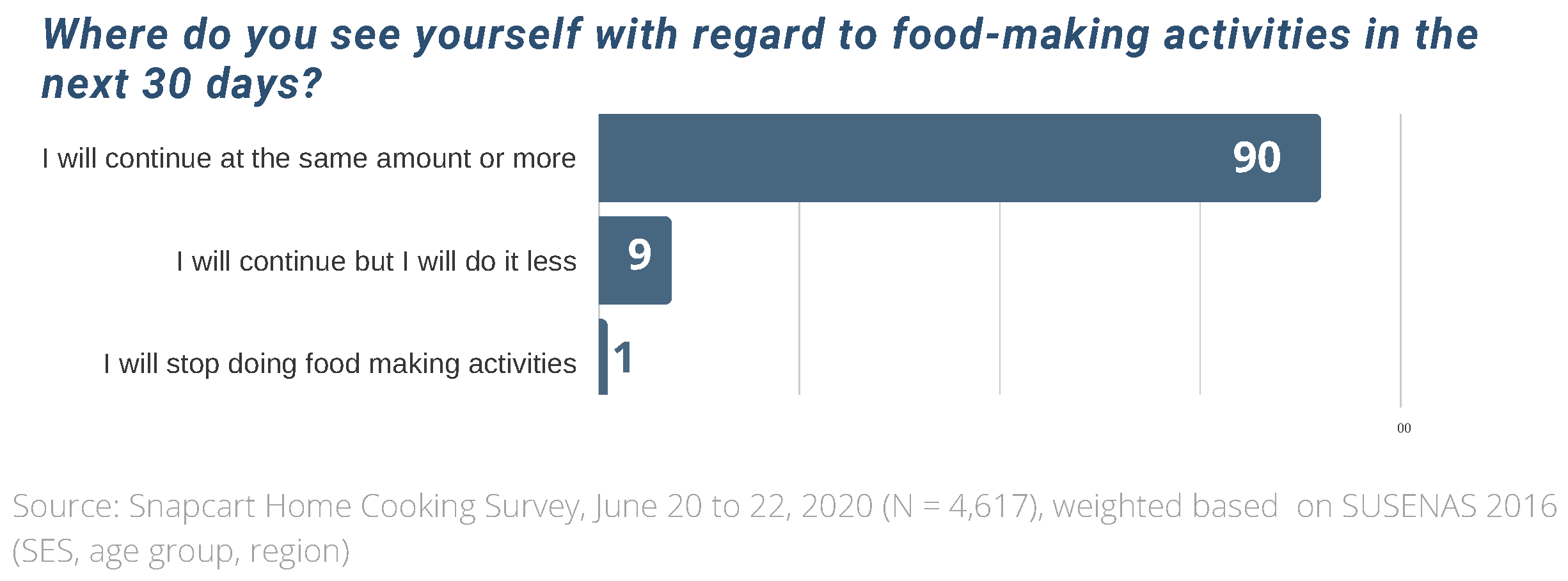

Consumers’ prospects. An overwhelming majority of respondents who cook or prepare food at home claimed they will continue to make homemade foods at the same frequency or more in the next 30 days.

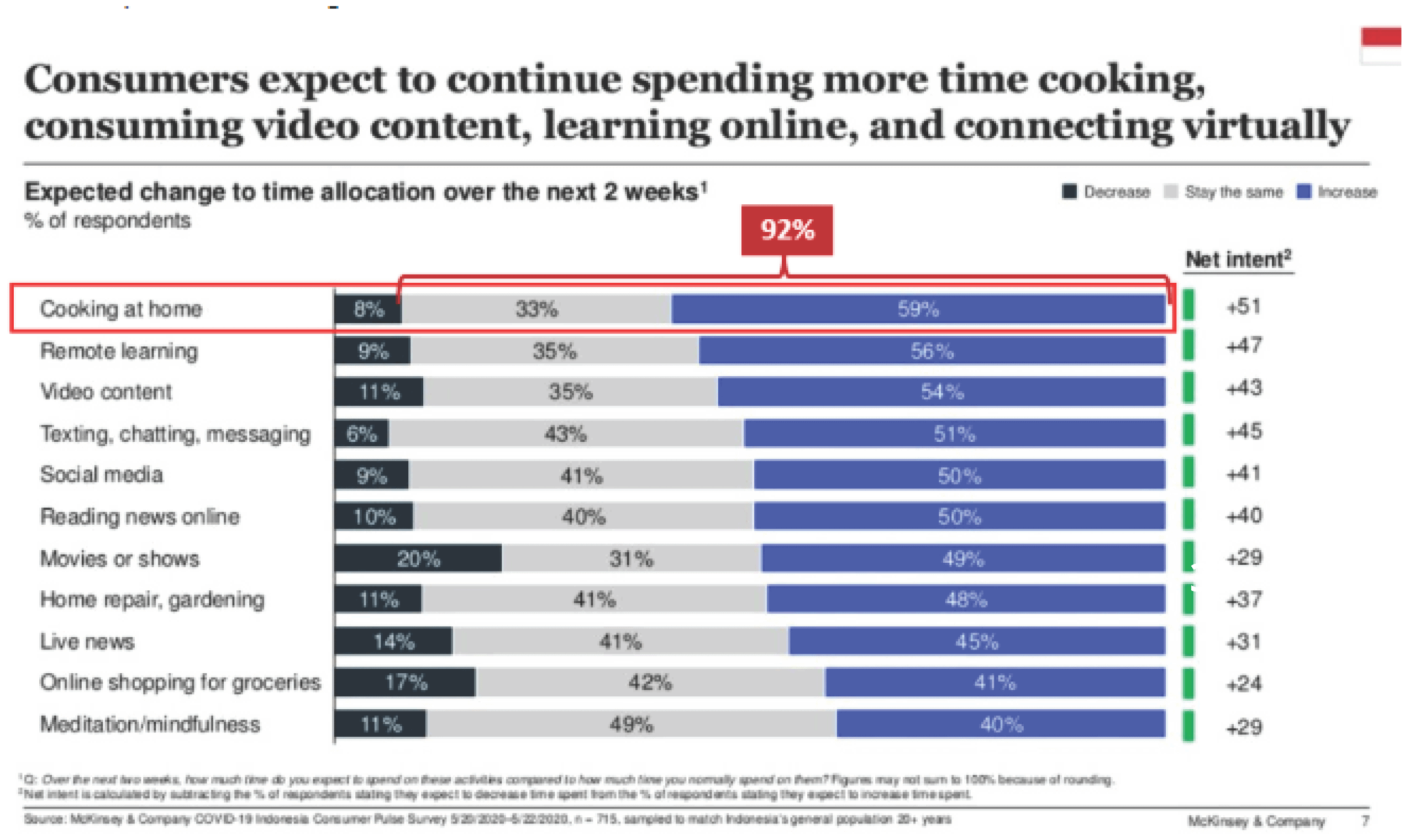

According to a study conducted by McKinsey & Company (COVID-19 Indonesia Consumer Pulse Survey), a total of 92% of consumers are expecting to spend more time cooking at home or continue the same amount of time spent on cooking.

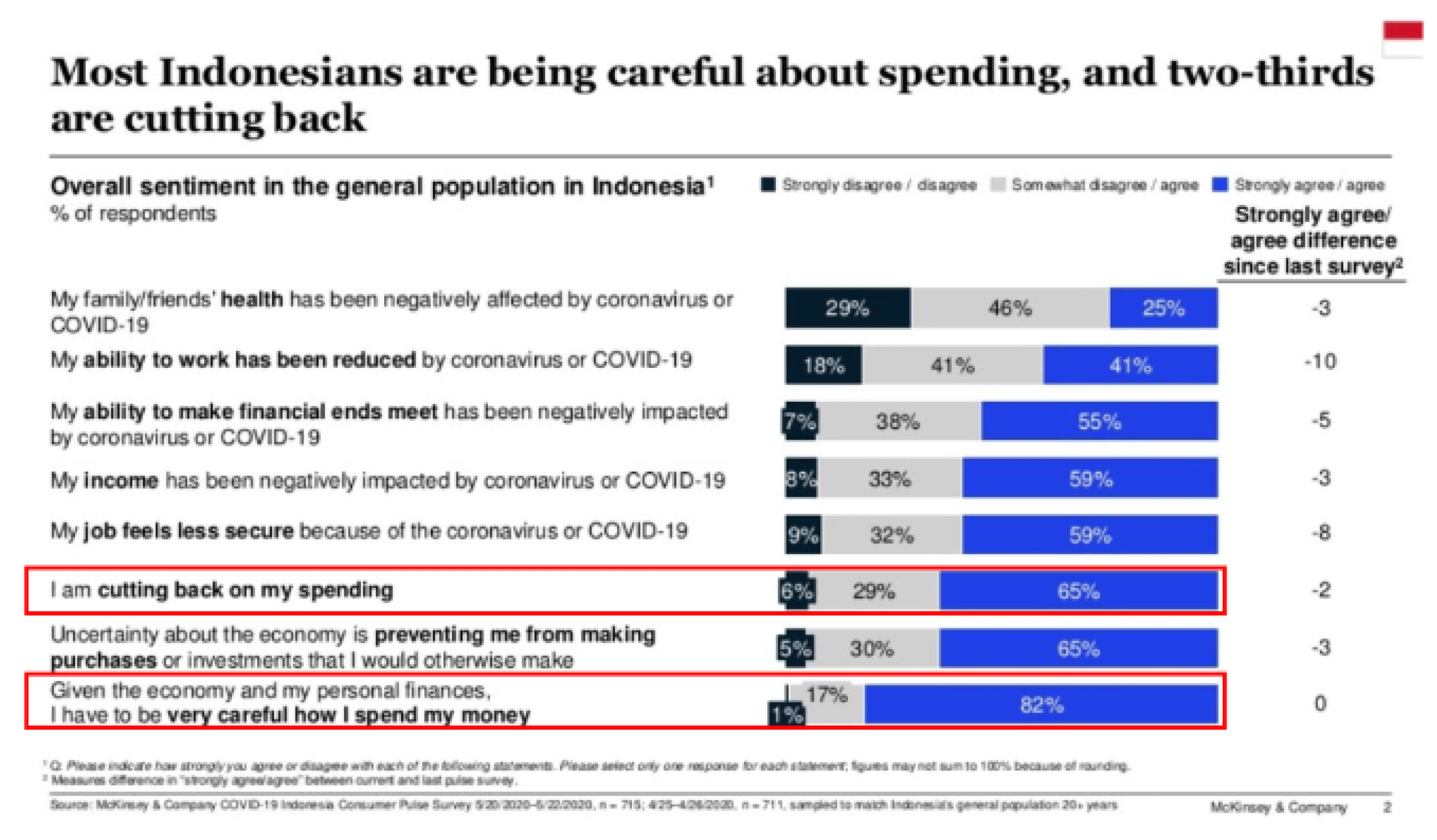

Consumer spending cuts. According to the same study by McKinsey on the Indonesian market amidst COVID-19, 65% are cutting back on their spending and 82% feel they have to be very careful about how they spend their money due to the economic uncertainty brought about by the pandemic. Keep this in mind on your monthly marketing plan. Price and value may be more important right now for consumers than their loyalty to your brand or the premium feature of your product that you are trying to market.

Hey there! Do you have a business question in mind for your category that you want to see a study on like the topic above? Please email me at partners@snapcart.global about your topic of interest. I am currently searching for interesting topics for our next articles. Looking forward to hearing from you soon!

Or click here to schedule a meeting.