The trend regarding investing your money beyond savings in bank and/or non-bank has been quite prominent among Indonesian consumers in the past few years. Financial education is also becoming more and more attainable, through social media accounts such as from Zap Finance and Elle May Institute, as well as the efforts such as from Bursa Efek Indonesia promoting stocks for retail investors. Of course, there’s still the traditional investment portfolio of real estate, which is still quite popular. So with all these options now available, how are Indonesian consumers opinions and choices in regards to investments?

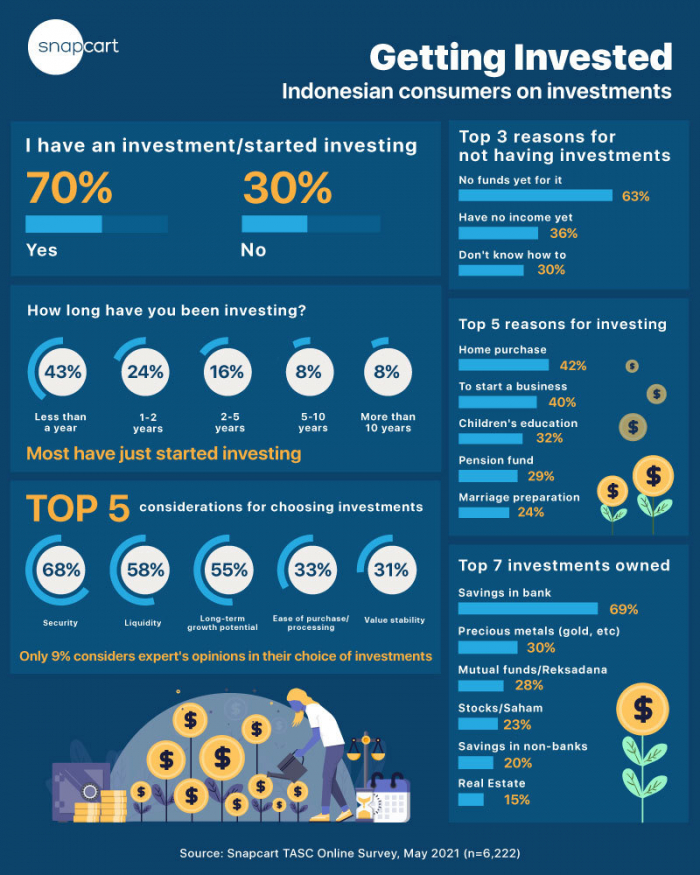

From our total respondents, 70% answered that they’ve started investing, with 43% of them have only started investing for less than a year or so. This is in line with the increase in trend regarding investments, and one of the main reasons for it is to aim for home purchase, of which 42% of our respondents answered it being their reason for having investments. For those who are yet to start investing, the top reason for that (62% of respondents) is due to unavailability of funds. If we look at the financial education contents currently available, a good amount talks about how to segment income so that people can start investing, so it is in line with current common worries: that people can’t start investing because they don’t have the funds for it yet.

How about you? Have you started investing, and what are your portfolio of choice? It will be interesting to find out more about Indonesian investment habits, so if you have any questions regarding it in mind, do try out the TASC free trial to ask our respondents about it!