Jakarta, 22 November 2021 – GrabFood is the leading food delivery service in Indonesia for both merchants and consumers in Indonesia, according to a new online study conducted by digital research firm Snapcart Indonesia. Deep-diving into the food delivery industry, the research is the first that studies both merchant and consumer perception across both tier 1 and tier 2 cities in Indonesia, namely Greater Jakarta (Jabodetabek), Bandung, Surabaya, Medan, Lampung, Purwokerto, Banjarmasin, Samarinda, and Makassar.

GrabFood the top food delivery platform used by merchants; delivers highest average daily sales

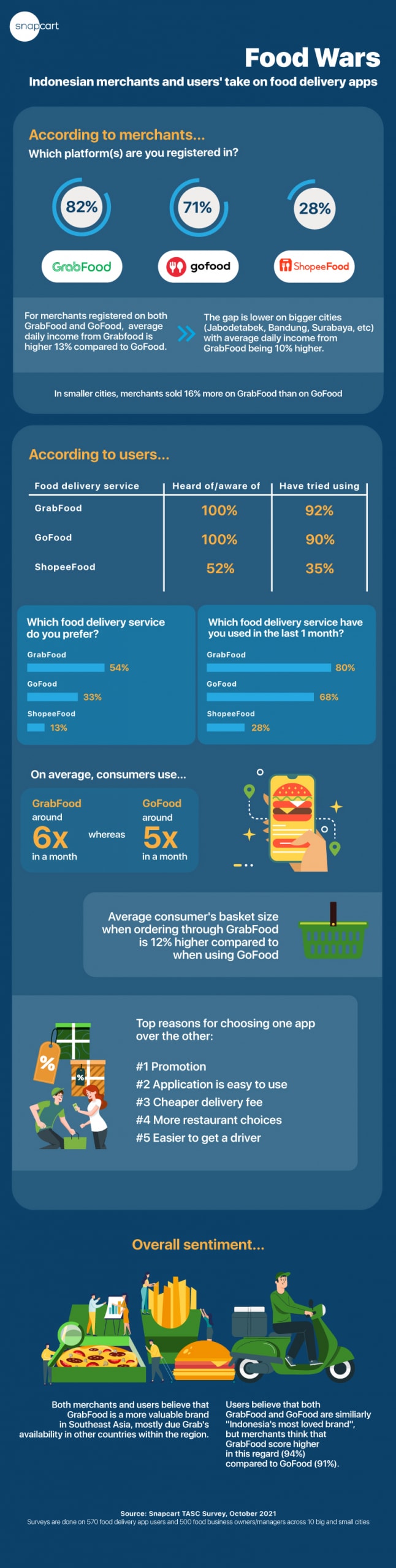

Amongst restaurants and food and beverage businesses that have used a food delivery service before, 82% use GrabFood, followed by GoFood (71%) and ShopeeFood (28%). 42% of merchants reported that they only started using food delivery services in the past 12 months.

The survey also found that merchants made a daily average of Rp 750,000 in sales from GrabFood, 13% higher compared to Rp 670,000 via GoFood. Breaking down this finding by cities – in big cities like Jabodetabek, merchants reported daily sales on GrabFood that were 10% higher than GoFood. In smaller cities such as Medan, Lampung, Jambi, Purwokerto, Banjarmasin, Samarinda, Makassar, merchants sold 16% more on GrabFood than on GoFood.

“While a lot of research on the food delivery industry has focused on the consumer experience, we wanted to take a more holistic approach in evaluating both the state of the industry as well as the competitiveness of the major players. That is why we included a merchant survey component. What we observed was that the merchant and consumer experience were two sides of the same coin, and findings on the merchant front were similar to what we saw with consumers. For example, we found that consumers used and spent more on GrabFood, and likewise merchants were also using and earning more from the platform,” said Astrid Wiliandry, Director of Snapcart, in Jakarta (2/11).

GoFood and GrabFood share equal brand awareness; consumers spend more on GrabFood

Amongst consumers that have used food delivery services, 36% indicated that they only started using these services in the past 12 months, while 54% reported that their usage of these increased during the pandemic.

Brand awareness and trial for GoFood and GrabFood were similar, while ShopeeFood trailed behind as the newest player in the market. 100% of consumers were aware of GoFood and GrabFood, while 52% were aware of ShopeeFood. Similarly, 92% and 90% of respondents indicated they have used GrabFood and GoFood respectively, while 35% have used ShopeeFood.

In terms of preference, 54% of respondents chose GrabFood as their preferred food delivery platform, followed by GoFood (34%) and ShopeeFood (12%). A closer look at spending patterns also found that consumers used GrabFood 6 times a month on average, and GoFood 5 times a month. The average order size on GrabFood was also 11% higher than on GoFood.

“We found that the top non-promo reasons for choosing a particular service came down to the variety of merchants and cuisines available, the usability of the app, and the ease of getting a delivery rider,” Astrid added.

Brand love

According to Astrid, one of the interesting things of this survey is that it also looked at measures of brand love in addition to measures of utility.

In that regard, the survey found that 85% of consumers agreed that GoFood was a brand loved by Indonesians. Likewise, 85% of consumers felt the same for GrabFood. Meanwhile, 90% felt that Grab has been beneficial to the Indonesian community, while 84% felt the same of Gojek.

Brand love levels were even higher amongst merchants, with 94% and 91% agreeing that GrabFood and GoFood respectively were loved by Indonesians. Additionally, 95% of surveyed merchants believed that Grab had helped businesses and entrepreneurs grow, with 93% agreeing the same for Gojek.

The online survey was conducted in October 2021 to Snapcart users across 10 cities, namely Greater Jakarta (Jabodetabek), Bandung, Surabaya, Medan, Jambi, Lampung, Purwokerto, Banjarmasin, Samarinda, and Makassar. The findings reported here are based on responses from 500 owners or people-in-charge of restaurants and food and beverage shops, who have used food delivery platforms, as well as more than 570 consumers who have used food delivery services.