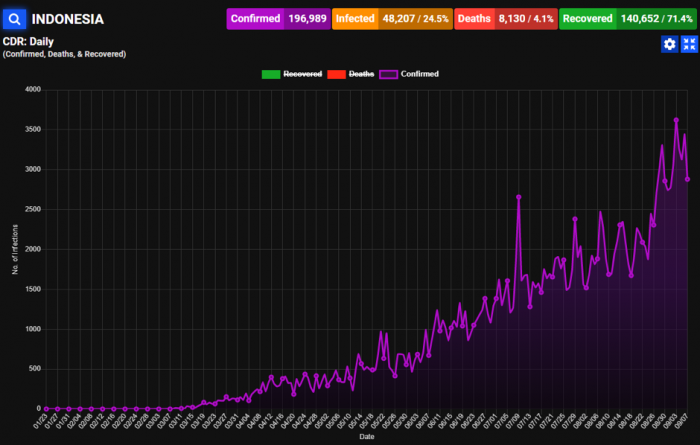

Lockdowns, social distancing and work-from-home arrangements have greatly disrupted the status-quo of essentially everything. Indonesia’s own form of strict social distancing (PSBB) was implemented earlier this year in April & May across its many regions which lasted between 2-4 weeks. This period, combined with daily infections reaching all-time highs has resulted in persistent new trends in consumer behaviour.

Online Shopping has Increased Significantly but Majority Still Prefers Going to Physical Stores

Just like many other shoppers in the world observing social distancing measures, the Indonesian consumer had every incentive to go online for their daily needs. Indeed, with market leaders like Shopee reporting a 130% increase in transaction volume in Q2 of 2020 [1] and Tokopedia reporting an increase of 1.8 Million registered sellers[2] since the start of COVID, the Indonesian e-commerce sector has enjoyed a period of unprecedented growth.

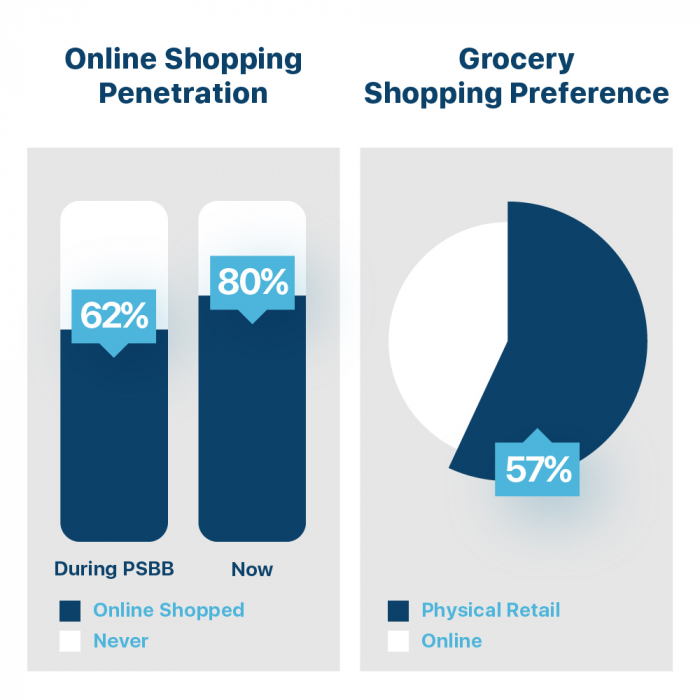

This has also been reflected in our latest survey (August) as online shopping penetration increased 18% compared to our past survey during PSBB (May):

Despite this increase in penetration however, 57% of Indonesian consumers still prefer going to physical retail stores to do their shopping despite pandemic concerns. Therefore, to minimize exposure, we have seen that consumers have begun increasing their basket sizes when it comes to groceries:

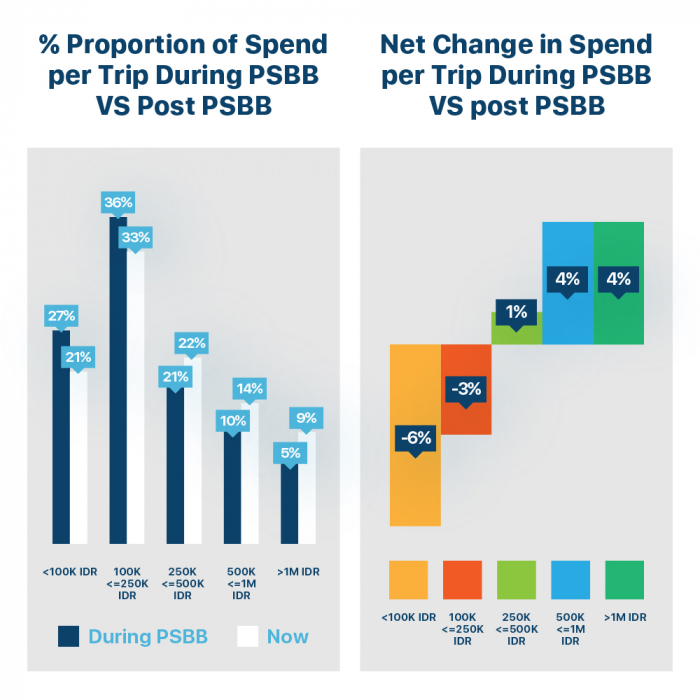

Consumers have shifted to larger spending per trip as the number of consumers spending below 250K IDR per trip has dropped 9% and has been completely shifted toward the top end above 500K IDR per trip.

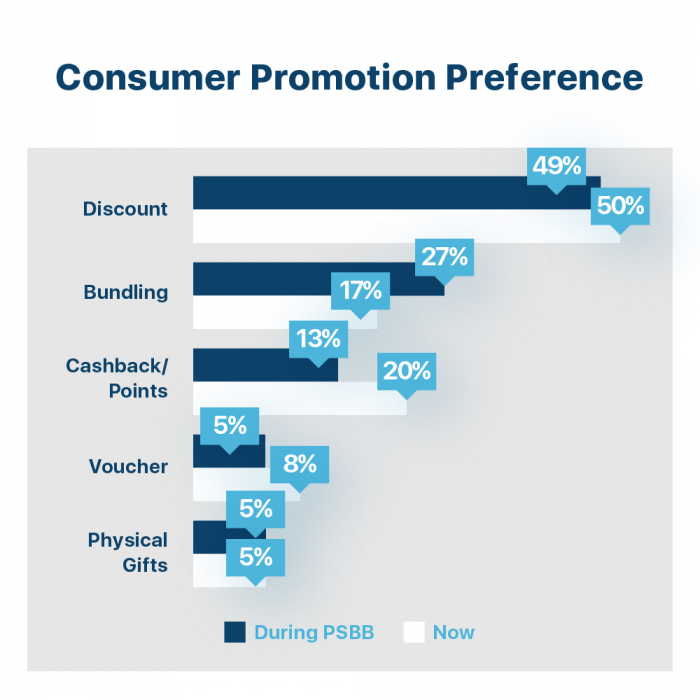

Post PSBB, 70% of Consumers Prefer Direct Discount and Cashbacks VS 62% Prior PSBB for Brand Promotions

Consumer preference for how brands should promote their products have also shifted as consumers are no longer in need of stocking up and the general economy has yet to fully recover:

At the start of PSBB was when consumers were still uncertain about what will happen and working from home became the new status quo for a large amount of people, bundling promotions were significantly more popular as people were more interested in securing supplies. Now, this has shifted completely into more direct-savings related promotions of cashbacks and vouchers.

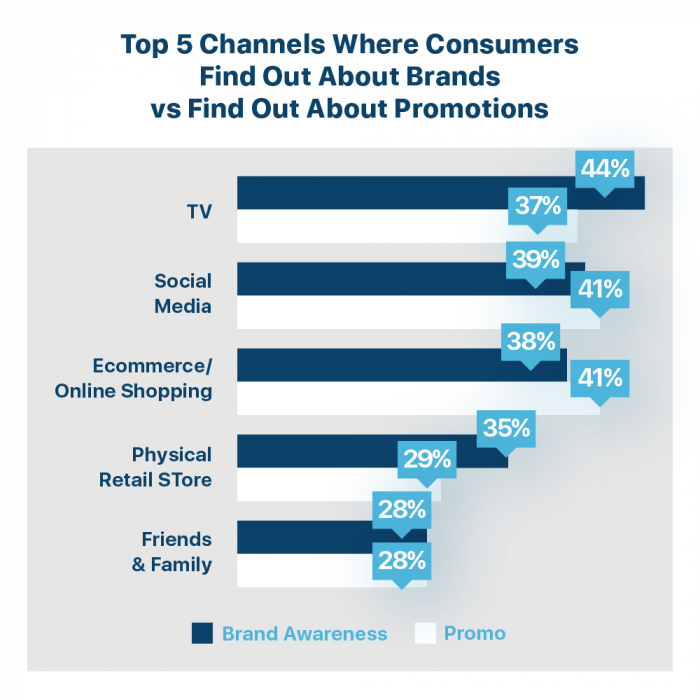

TV currently takes the lead on brand awareness whereas for promotions/discounts/sales, social media & online channels take the lead. In combination, our data suggests that to win the pre-buy in of the consumer, brands must engage them online with the relevant direct savings propositions.

Now that the situation has somewhat achieved a post PSBB normal—with laxer social distancing measures—brands must adjust their strategies to better sell to consumers. Though consumers remain fixated on offline shopping for their groceries for the time being, brands will find that reaching them digitally is the optimal channel. As consumers make less trips to retail stores, spend less time browsing in-store, are increasingly price sensitive and come prepared with what they want to buy[3], brands must reach ‘top of mind’ for the consumer before they even reach the store.

Market Share Up For Grabs

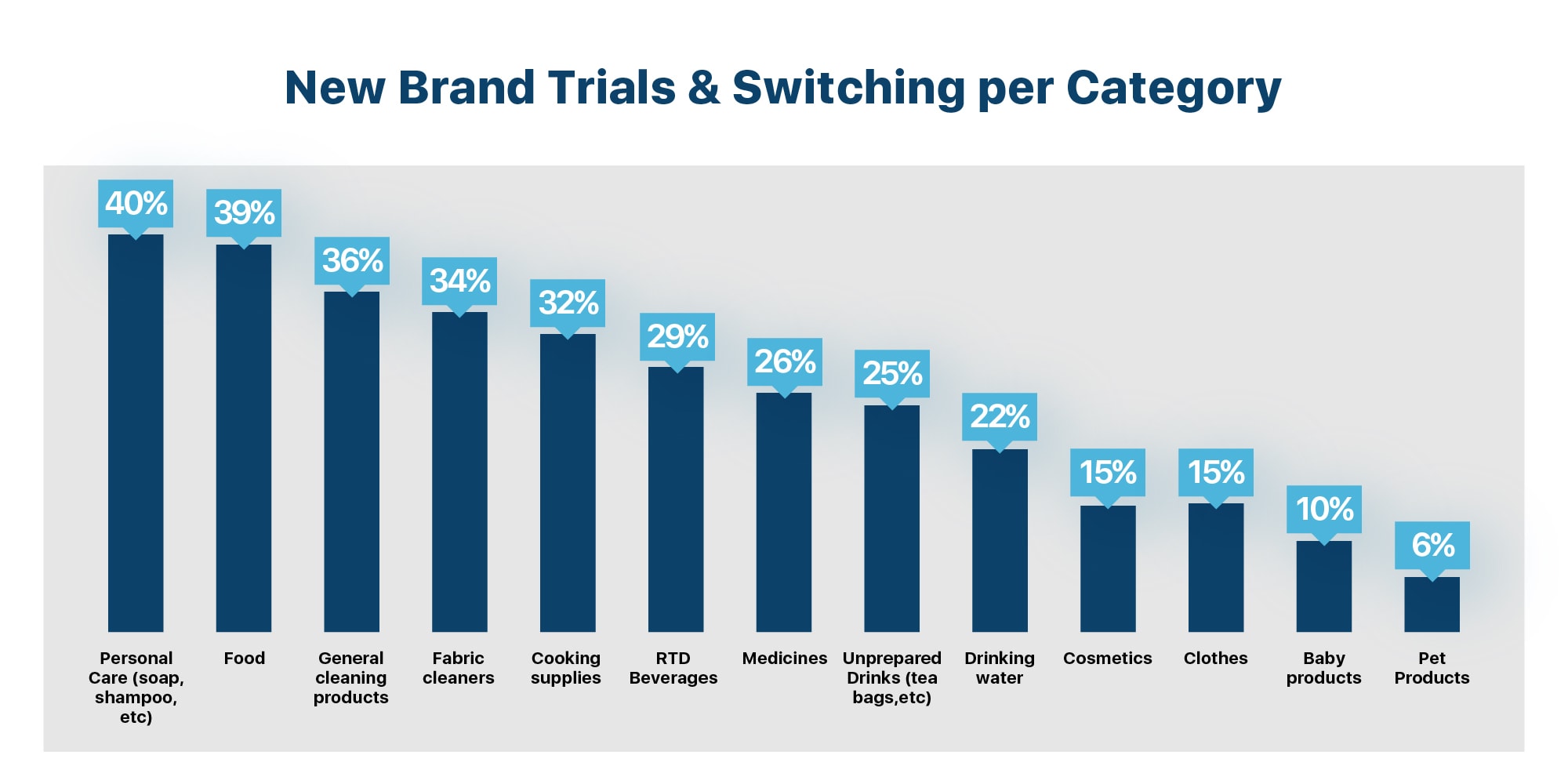

COVID19 has proven to be an upheaval to brand loyalty too with consumers now very flexible in trying new brands both as they become more economical and cook more from home[4]. In our August survey, 66% of consumers have stated that they have tried new brands and/or switched brands.

As the main shoppers for the family, females have shown to be on average 33% more likely than males to have tried new or switched brands. The shift appears to also have an economic basis as middle and lower socio-economic consumers were both 16% and 13% more likely to switch or try new brands respectively.

“66% of consumers have stated that they have tried new brands and/or switched brands”

The sudden changes to how businesses operate globally has had a tremendous impact on supply chains for FMCGs, leading to out-of-stock and availability issues. In Indonesia, those who had the logistical capabilities won out on consumer perception as 58% of consumers felt that the brands which were stocked and available during PSBB were deemed most reliable whereas 30% deemed brands that were difficult to attain and out of stock to be perceived as unreliable.

The current situation presents opportunities for newer, smaller brands to gain market share as consumers are more adventurous with trying and switching brands. The market appears to have a gap for more economically priced products for which both large and small players will likely need to compete, whether this comes in the form of new products, sizes or promotion strategies. At the same time, brands must ensure their distribution is as wide and reliable as possible lest they erode their own market share as consumers buy and try other brands instead.

Don’t Neglect Advertising

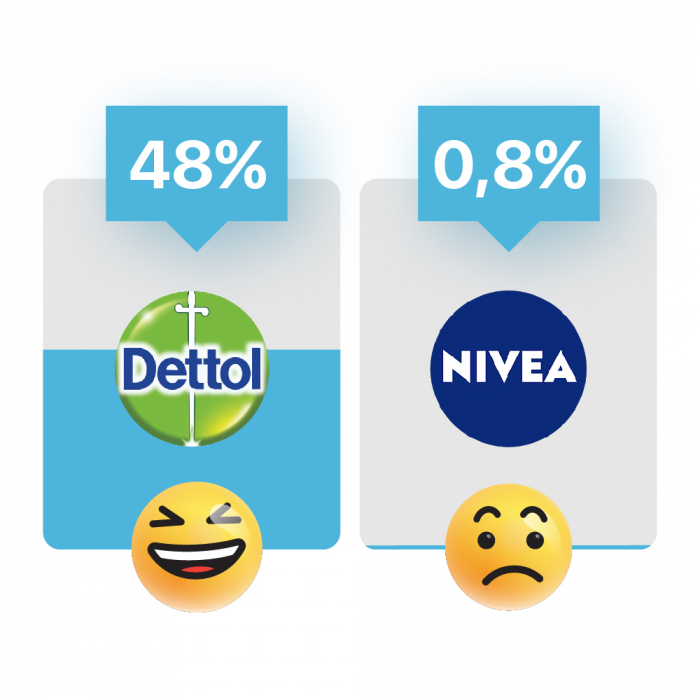

Given the uncertainty of their business, large amounts of companies in Indonesia slashed their advertising budgets and ad spending fell by 25% at the start of Q2 this year[5] to minimize costs. Though this may be a valid decision in the case of out of home formats as consumer mobility is limited, the general decline in ad spend across all mediums impacts consumer perception towards the brand. We will take a look at how this has impacted two different brands in the hand sanitizer category.

In a recent survey (August), we surveyed consumers on the hand sanitizer brands: Dettol, Antis, Betadine, SOS, Nivea and Lifebuoy. Looking at both extremities we saw the clear pattern that even under these challenging circumstances, advertising cannot be neglected:

48% considered Dettol the most useful brand in the category survey with 37% of all respondents recalling that Dettol advertised the most and delivered the most effective ads. In contrast, Nivea only garnered 0.8% of the votes for the most useful brand. This is corroborated by the 2% of all respondents who considered the brand to be advertising the most often and effectively.

“The general decline in ad spend across all mediums impacts consumer perception towards the brand.”

As we’ve shared above, focusing the majority of the ad budget on digital and TV appears to be the most optimal and will reach the greatest number of consumers. Brands today face a difficult budgeting situation and must now truly maximize return on investment when it comes to their advertising.

In summary:

- Offline is still the dominant channel for shopping and groceries, but online is the best channel to communicate promos

- The majority of consumers are more flexible with brand loyalty and prefer lower price or direct cost-saving incentives to get them to purchase

- Since consumers make less trips for groceries, availability is doubly important both for market share and consumer perception

- Advertising still cannot be neglected as they directly impact consumer perception within the category and brands should be focusing on TV and digital for the majority of ad spending to maximize effectiveness

Snapcart has a COVID19 customer sentiment tracker you can follow here. If you’re interested in doing your own research on customer’s sentiment during the new normal, please reach out to us here.

*this research is based on TASC Surveys between May-August 2020 concerning the PSBB within and prior to that period.

Sources:

[1] https://inet.detik.com/cyberlife/d-5155740/masa-pandemi-transaksi-shopee-di-q2-2020-naik-hingga-130

[2] https://economy.okezone.com/read/2020/09/08/455/2274513/jumlah-penjual-online-naik-sebanyak-1-8-juta-orang-selama-covid-19

[3] https://snapcart.global/how-to-maximize-promotions-amidst-covid-19s-impact-on-indonesian-in-store-habits/

[4] https://snapcart.global/the-shift-in-consumer-behavior-from-eating-out-to-home-cooking-how-should-you-adapt-your-marketing-strategy/

[5] https://www.thejakartapost.com/news/2020/05/13/ad-spending-plunges-as-companies-reduce-marketing-activities-amid-outbreak-.html