Financial inclusion in Indonesia is steadily rising. According to an FII survey, bank account ownership amongst adults in 2018 has increased to 55.7%, significantly higher than 2016’s 35.1%1. Digital banking is expected to further boost financial inclusiveness in Indonesia, as from a 2017 survey, more than 50% respondents have shown likelihood in using digital banking in the next 6 months2.

With 69% of the unbanked segment owning a mobile phone, estimates show that introducing digitized financial products can reduce up to 29 % of unbanked adults national share3. Per June 2021, there are already seven digital banks registered under Indonesian Financial Service Authority (Otoritas Jasa Keuangan/OJK) and seven others who are still in process to become digital banks4, with a combination between established banks (i.e., Jenius, DBS Digibank) and neobanks, which are usually digital financial institutions established by companies after the acquisition of local lenders or commercial banks5. And this is only talking about digital banks. With no shortages of e-wallets, investment platforms, and digital financing facilities available in the market, expectations are quite high.

Audience Profile

This survey was conducted online on February 2022, by Telkomsel and Snapcart through tSurvey platform towards Telkomsel users (n=150). We asked questions regarding financial products that includes digital ones such as digital banking as well as investment platforms. Answers are also combined with some conventional financial product ownership and use, for comparison.

The Digital Landscape

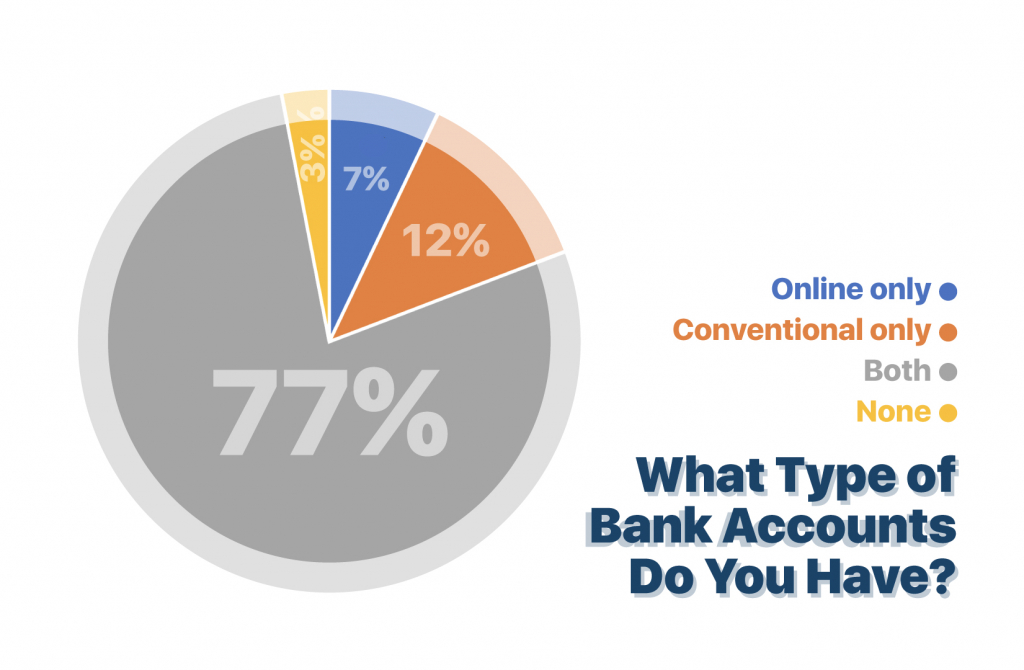

Although people are opening up to the concept of digital financial products, with 77% respondents now owning both conventional and digital bank accounts, only 7% own exclusively digital bank accounts. This can be a challenge to the idea that digital banks are meant for the unbankables – assuming that the unbankables are meant to exclusively have digital bank accounts due to their various difficulties to access conventional bank accounts. But coming back to digital utilization, 86% respondents who own both conventional and digital ways to access their financial products answered that they now use online methods more often than offline/conventional ones, meaning that the level of adoption is quite significant.

Source: tSurvey X Snapcart Online Survey, February 2022

Deloitte’s study mentions digital financial products, especially banks, are expected to be more attractive for older demographics due to the higher rates of return for their investments6. From our results, the age group of respondents over 45 years old does show a higher tendency towards accessing their digital financial products online at 94% audience, compared to other age groups that averages around 85%.

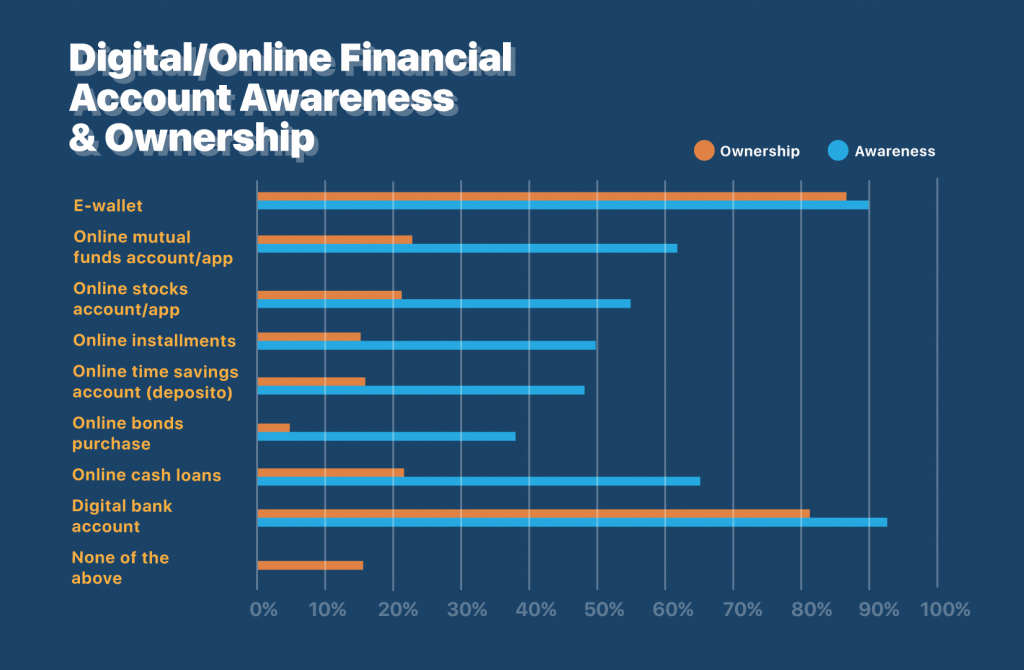

Looking at overall ownership, digital bank accounts are still the most popular, with 92% respondents being aware of them and 82% owning them. Lowest ownership seems to be for online purchase of bonds, of which the government is also trying to push as well7, with 38% awareness but only 5% ownership. Other online investment products, such as time savings, mutual funds, and stocks, are relatively higher both in terms of awareness as well as ownership, but unfortunately still loses out in awareness compared to online cash lending platforms.

Source: tSurvey X Snapcart Online Survey, February 2022

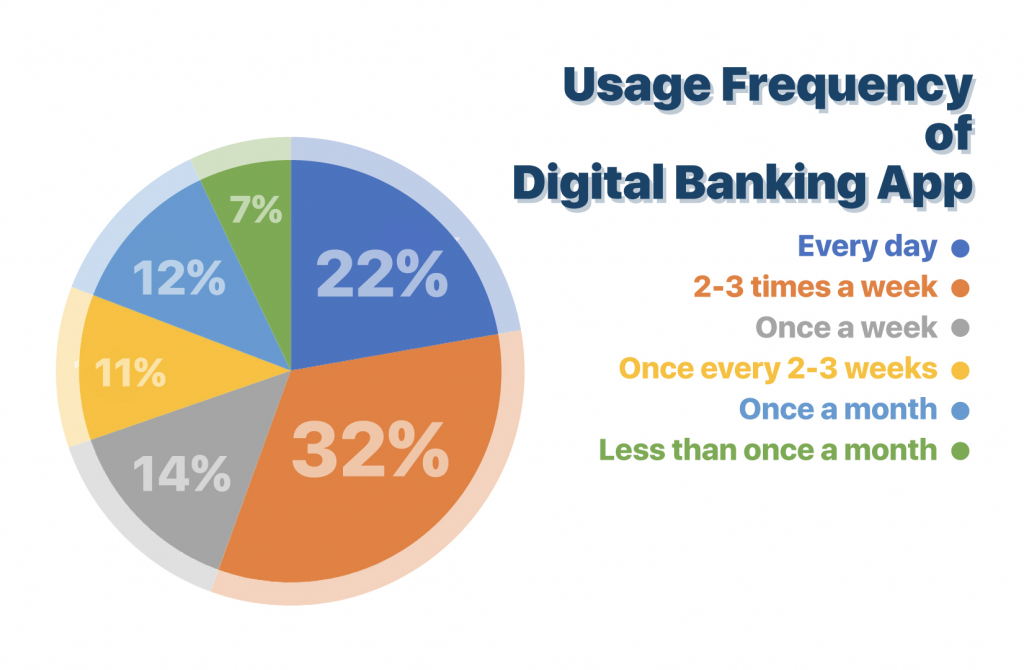

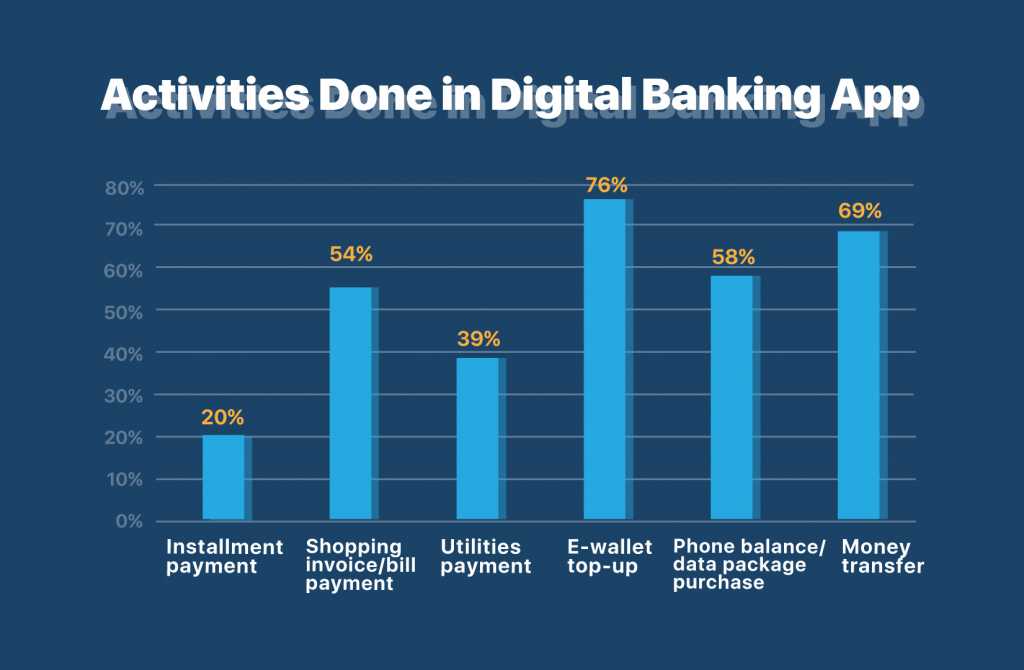

With high general awareness of digital banks as well as its ownership, how often do people utilize them? It seems that the consensus is 2-3 times a week, with 67% respondents who own digital bank accounts answering so. Only 11% only have activities with their digital bank app once a month or less often. Most of them are using their digital bank account to transfer money (81% respondents) as well as topping up their e-wallet (80% respondents). This is in line with one of the main reasons people open digital bank account: 58% answered that their reason is due to the attractive promotions, which usually includes free interbank transfer fees as well as free service fee for topping up e-wallets.

But is that all that’s attractive from digital banks? Top reasons for people opening digital bank accounts also includes ease of account creation (69% of respondents) as well as clearer, more accessible information (58% respondents). For a lot of the unbanked crown, lack of access to banks can be the reason for them not having a bank account, with 33% of the unbanked stating distance as their main reason3. Hence, it made a lot of sense that ease of opening accounts is one of the main reasons of digital bank’s popularity.

Customer service responsiveness can also be a factor, as especially with an app installed on their phones, they can practically contact a bank representative at any time. Regulation-wise, OJK also mandates 24/7 customer service through the app for digital bank players8, so this can further boost attractiveness of digital banks for Indonesians.

Source: tSurvey X Snapcart Online Survey, February 2022

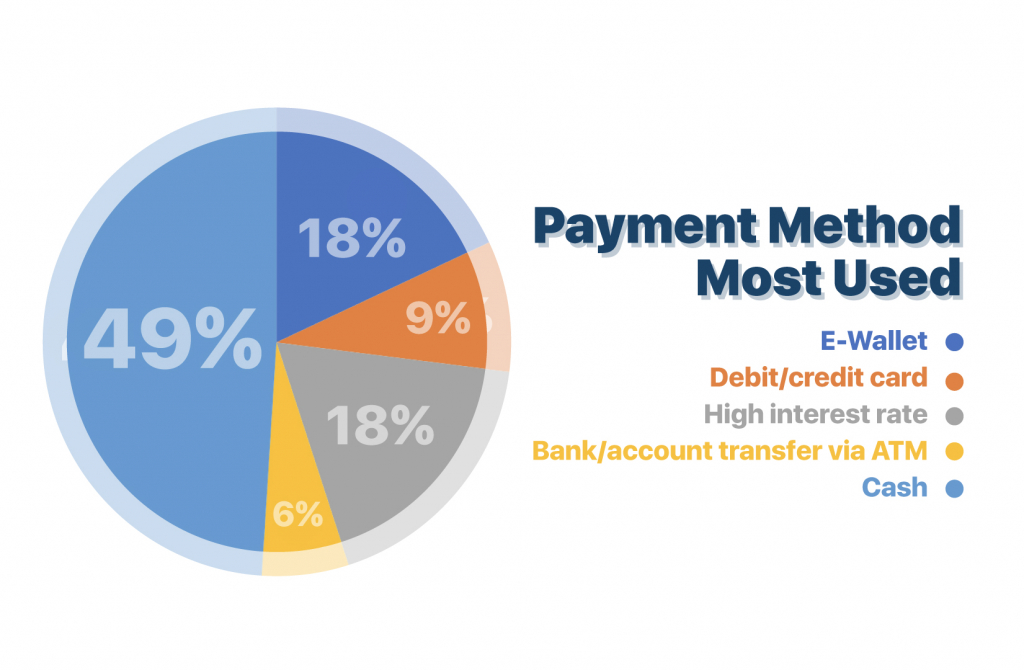

With financial products trend shifting to digital, does it also reflect to how Indonesians do their transactions? Despite the healthy trend towards digital, cash is still king with 49% respondents still using it more often for their transactions. This is interesting, especially knowing that cashless transactions on the rise, especially during the pandemic8. The number of people who transfer their payments via app are now much higher than those who does so via ATM, at 18% and 6% respectively. The amount of people who most often use e-wallets are also high, at 18% of respondents.

Digital payment transaction is steadily growing in Indonesia, with around USD 13,95B in value in 20209 and forecasted to grow even more. The various digital financial ventures in Indonesia will be at the forefront for that.

Source: tSurvey X Snapcart Online Survey, February 2022

The Touchpoints

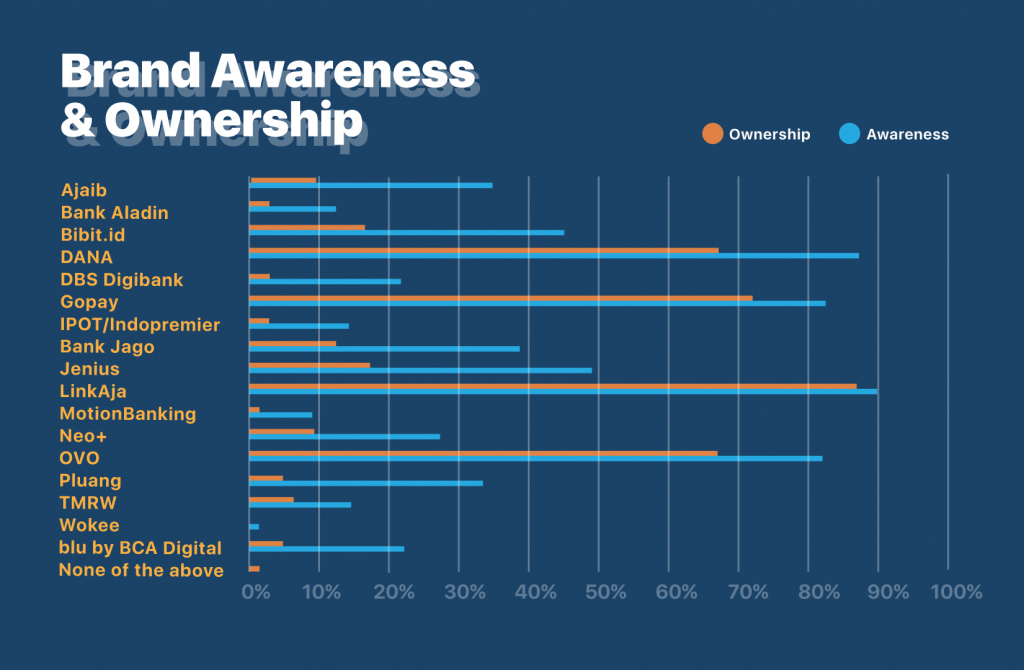

Looking at some of the current players in the digital finance sector, it is evident that e-wallets are still the ones with the most customer penetration. Even with older digital bank brands like Jenius, awareness is only at 49% respondents with 17% ownership, whereas DANA, for example, has 87% awareness and 67% ownership. Digital investment brands have begun to pick up as well, with brands such as Bibit.id having 45% respondent’s awareness and 17% in ownership.

With consideration of the relatively heavy promotions a lot of e-wallets do, does promotions play a significant part in achieving awareness and ownership? When we look at the case for digital banks, it might be so, as when asked what’s the most important aspect to have for a digital bank, plenty actually answered promotions when opening an account (16% of respondents). Curiously, 32% answered that a cool logo is also very important (32% of respondents)!

Source: tSurvey X Snapcart Online Survey, February 2022

Towards a Digital Future

Level of digital finance adoption in Indonesia shows promising results. With the help of things such as promos and good communication as well as integration towards everyday activities, digital financial products are becoming more and more common in use. However, there are still a lot of untapped potential, and with the current trend, we are expecting even more growth in the digital financial sector.

Sources:

1 Shrestha, R. & Nursamsu, S. (2020). Financial Inclusion and Savings in Indonesia. ERIA Discussion Paper Series No. 344.

2McKinsey&Company – Digital banking in Indonesia: Building loyalty and generating growth

3Fintech Singapore – World Bank Global Findex: Indonesia Leads in Financial Inclusion Progress

4Bisnis.com – Sah! OJK Tegaskan MotionBanking (BABP) Sebagai Bank Digital

5Techwire Asia – Here’s how digital banks in Indonesia will gain a foothold this year

7CNBC Indonesia – Surat Utang Diborong Warga Lokal, RI Tak Roboh Digoyang Asing