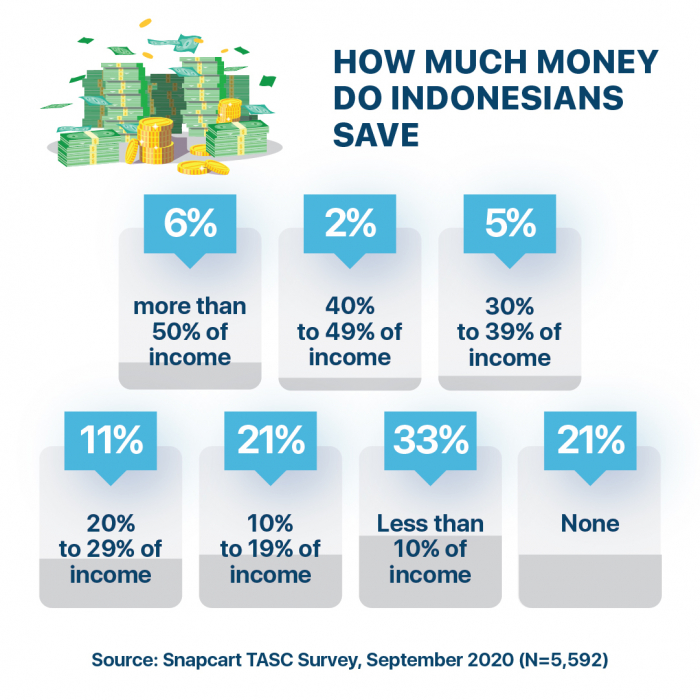

Nobody could have predicted the occurrence of COVID19 pandemic and its economic implications to countries across the globe. One of the many things most people wish they have done earlier in their lives is savings, especially for rainy days whether it be global financial crisis, healthcare cost for loved ones or family hardships caused by this pandemic. We have surveyed a total of 5,592 Indonesians across age groups, socioeconomic status groups and geography to understand more about their current savings habit. Unfortunately, roughly about 21% of Indonesians do not save money at all from their monthly income earned and 33% save less than 10% of their income. However, 6% of Indonesians were able to save more than 50% of their income.

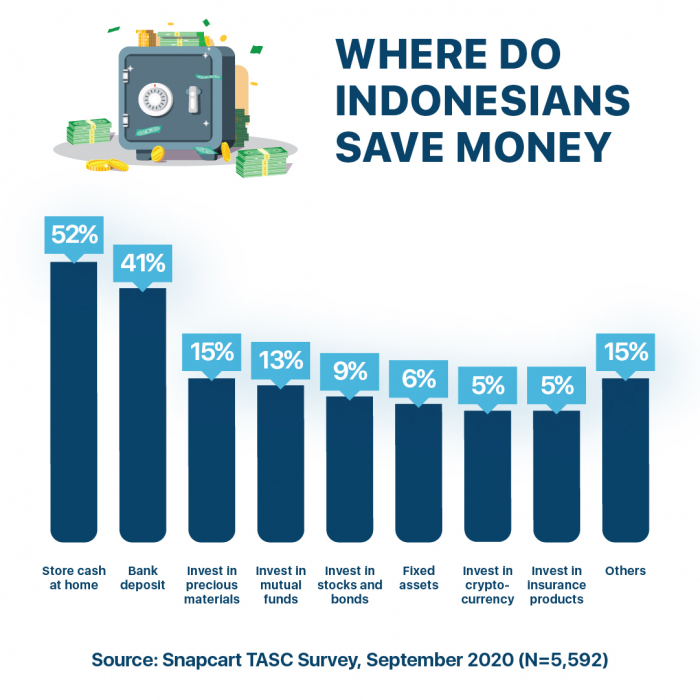

Most Indonesians Still Store Part of their Savings at Home

From the 79% of Indonesians who save money regularly, overwhelmingly 52% save their money by storing cash at home and 41% save in their bank account as part of their savings strategy. Further research is needed to find out reasons for their preferences and allocation of how and where Indonesians save money.

However, surprisingly, 5% of respondents have already started investing in cryptocurrencies, the same percentage as investing in insurance products.

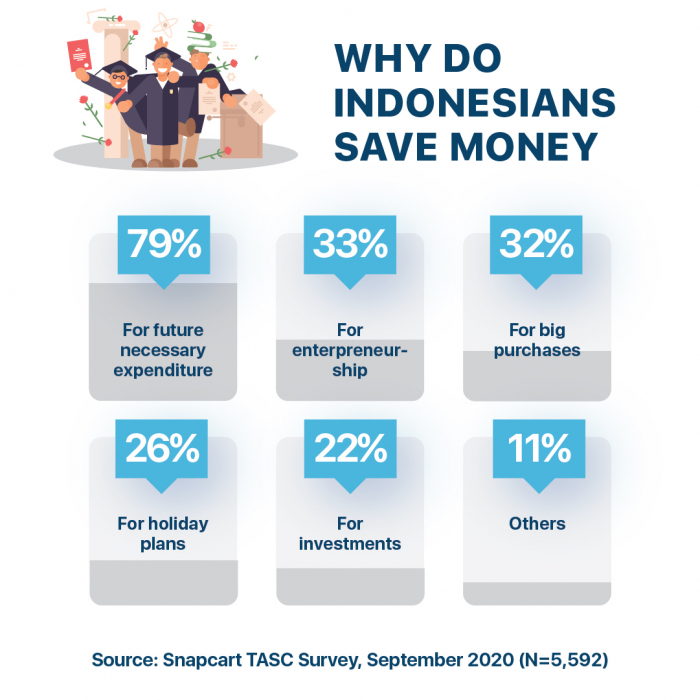

33% Save to Start or Manage their Own Businesses

When asked why Indonesians save money, 79% said they save for future necessary expenditures such as education for kids and healthcare for family. Interestingly one in third of respondents also save to start their own business in the future while 26% save for holiday plans. Across both genders, the reasons for why they save are relatively uniform, except for saving for investments where Men were 85% more likely to save for stocks & bonds and 54% more likely to save for mutual funds. This indicates a potential financial education gap between Men and Women when it comes to the financial markets—an untapped market considering Indonesia has a near exact 50-50 split in population gender.

The Takeaway

Although most Indonesians save their money, not many get to save a significant amount. In fact, only 24% of Indonesians save 20% or more of their monthly income. The two most preferred places to save money are at home and bank deposits, while only a few prefer to save their money in investments. This could be a result of lack of proper access to financial products, lack of investment understanding and/or lack of trust for local financial institutions.

With all the above points taken into consideration, financial technology companies may very well help many Indonesians, be it for providing easy access to bank accounts, access to investment products and advice, or simply help elevate Indonesians financial literacy.

Other articles you might like: How does Indonesians view credit cards?

If you would like to learn more about Indonesians’ savings and investments habits, please feel free to reach out to us here.

These insights are made possible by Snapcart’s TASC, which gives quick results from audiences across Indonesia. Want to know how you can get insights of your own? Find out here.

Sources:

- The Importance Of Saving Money: 15 Reasons to Start Saving

- The 50/30/20 Rule of Thumb for Budgeting

- Cash is king: Indonesians withhold spending, augment emergency funds

- INDONESIA MENGAWALI 2020 DENGAN INDEKS KEYAKINAN KONSUMEN PERINGKAT 4 TERTINGGI DI DUNIA

- 7 Ways Fintech is Transforming Everyday Life