Getting Invested

The trend regarding investing your money beyond savings in bank and/or non-bank has been quite prominent among Indonesian consumers in the past few years. Financial

The trend regarding investing your money beyond savings in bank and/or non-bank has been quite prominent among Indonesian consumers in the past few years. Financial

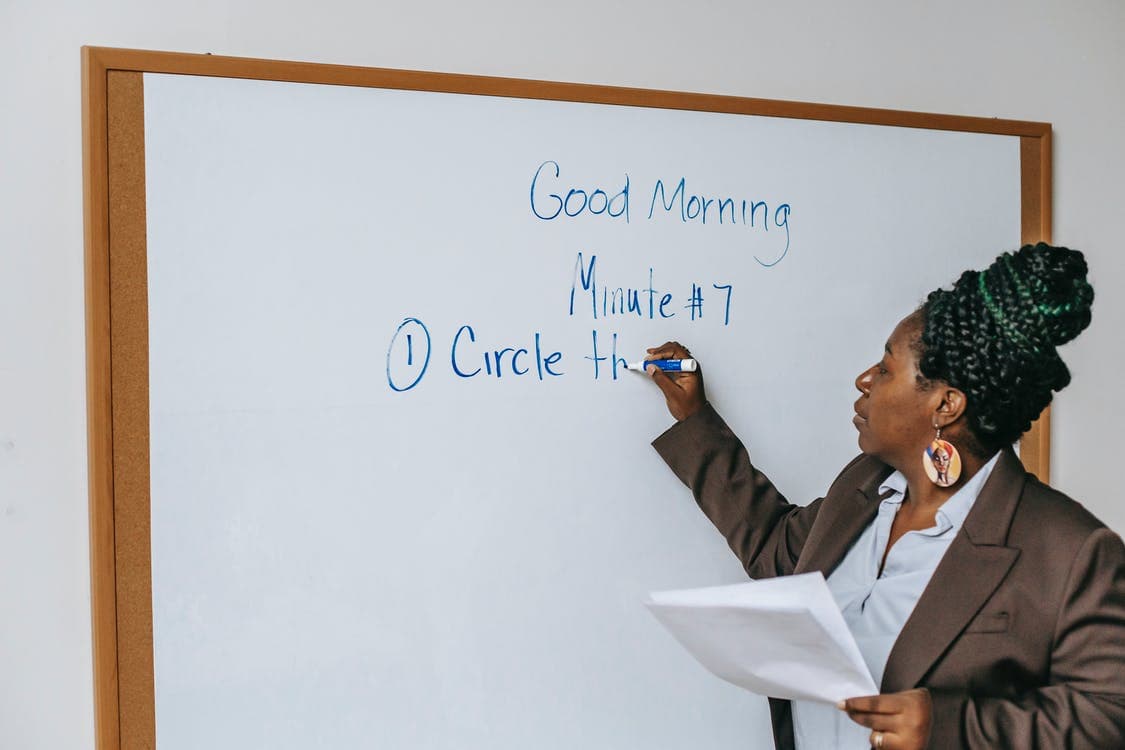

Education is one of the main sectors that are severely impacted by the pandemic. Over 530.000 schools have closed, affecting around 68 million students[1], limiting

Ramadan, aside from a time for Indonesians to spiritually recharge, is also a time of gathering and togetherness. Hence, it is interesting to see how

(Image credit: Wikimedia Commons) With Ramadan arriving, conversations about mudik (going back to one’s hometown, usually done during holidays) have started to come up. However,

The pandemic affects a lot of us in different ways. Be it how we go about our daily lives, how we work, and many more.

The COVID-19 pandemic has had a substantial impact on the movie industry in 2020. Across the world and to varying degrees, cinemas and movie theatres

Stay up to date with our latest findings

In today’s fast-paced lifestyle, many Indonesians find themselves deeply attached to certain products that bring them comfort, entertainment, or simply a sense of satisfaction. What’s

In the first part of this post, we discovered that only 10% of Indonesians rely solely on shampoo without using other hair care products [1].

In a world where customer expectations, technology, and competition evolve rapidly, businesses cannot afford to stay stagnant. A strong brand today might feel outdated tomorrow

Indonesia, a nation known for its vibrant democracy, is currently experiencing a period of heightened social and political unrest. Recent large-scale protests, sparked by public

These days, the variety of hair care products has expanded significantly. Our recent survey in August 2025 discovers that more Indonesians are now paying attention

Financial anxiety is one of the strongest forces shaping consumer behavior in 2025. Rising living costs, global economic uncertainty, and household debt are pushing people