It is easy to see how CPG giants have been winning heavily in this day of lockdowns and quarantines. This is due to consumers shifting to doing almost all activities at home and falling back to buying their tried and tested brands which are, in most cases, the biggest and oldest CPG brands.

Is this bad news for smaller and newer CPG players? Not necessarily.

CPG is one of the very few industries still growing in the age of Covid-19 and is projected to keep on doing so until May in a conservative estimate. This means the pie has gotten much bigger, and so while the big players are the number one beneficiaries of this growth, small players are benefiting from this new growth as well.

A Big (and rare) Opportunity

While there may not be a CPG supply issue, grocery stores still encounter frequent stock challenges because of logistical issues. This logistics issue inflicts the most in-demand categories and brands, opening the door for smaller brands to come in and supply shopper demand while the big players are refilling their stocks.

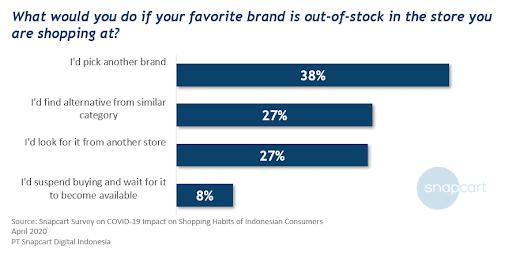

How does this logistics issue impact Indonesian shoppers? When faced with a situation where the favorite brand is out-of-stock, around half of shoppers would pick another brand.

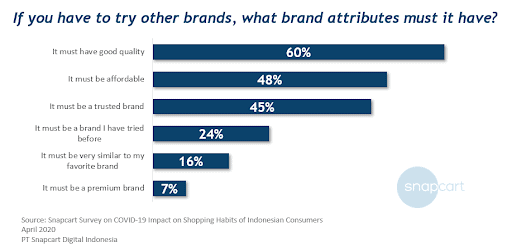

To maximize the opportunity of getting trialist buyers from a bigger brand, a smaller brand must make sure that it is perceived as having at least one of the attributes of: good quality, affordability, and trustworthiness. Fortunately for smaller brands, when in this situation, they don’t have to be a perfect substitute for the favorite brand as only 16% of shoppers require the trial brand to be very similar to the favorite brand.

An Even Bigger Opportunity

The other half of shoppers who would find ways to still buy their favorite brands in case they are out-of stock answered so having their favorite brands in mind. However, in CPG, there are not many strong favorite brands for buyers if compared with more brand-conscious category buyers like in Fashion, Tech, and Sports. This means there is an even higher chance of gaining new buyers via increase in trials.

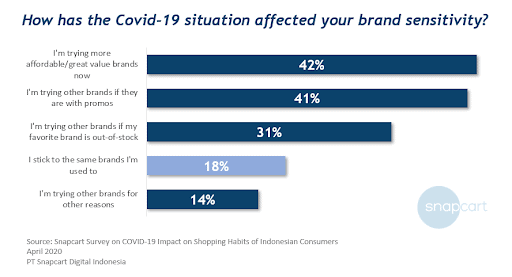

In fact, in our survey, shoppers who are trying other brands due to out-of-stock issues are only 31% of shoppers who claim their brand sensitivity has been affected by the Covid-19 situation. A greater percentage of shoppers try other brands for more economical reasons such as affordability/”great deal” proposition (42%) and presence of promotion on those brands (41%). Only 18% of buyers say that they still stick completely to the same brands they are used to despite the situation.

Recommendation for small CPG players

Covid-19 has shaken up the playing field knocking many players down no matter their size, while giving advantage to others. It has changed the field to something that is equally unfamiliar to all the players. Small players in every industry can use this reshuffling of cards to boost their standing in the competition. Thus, they must take advantage of every opportunity that comes from this recent change in some rules of the game.

For small CPG players, iIf your brand is not perceived as affordable or a “great deal” product, try to create and maximize the power of promotions and take advantage of the big brands’ stock issues by having at least one of the attributes of: good quality, affordability, and trustworthiness to widen the opening of your sales funnel. The potency of these efforts are higher now more than ever as the majority of shoppers see their brand sensitivity decline during this pandemic. Watch out for stronger emergence of recessionary purchase behaviours and prepare strategies on capturing the attention of more purpose-driven, economic, and risk-averse shoppers.

Would you like to see this study’s results specifically in your industry or category?

References: